|

DOI: 10.7256/2454-0668.2022.5.38848

EDN: DLBNVP

Received:

28-09-2022

Published:

06-11-2022

Abstract:

The article is focused on the regional and national insurance mechanisms in developing countries. Their activities and these in the context of the COVID-19 pandemic, as well as strengthening geopolitical tension are considered. The subject of the analysis is the mechanisms of the functioning stabilization funds in developing countries, such as the Chong Mai Agreement, BRICS Contingent Reserve Arrangement, FLAR, EFSD, and the national insurance mechanisms in such countries as Russia and Saudi Arabia. The authors analyse the main formation stages and the purpose of creating these mechanisms, sources of funding and the main activities, as well as the structure of investment portfolios. The study is based on general scientific methods of cognition, such as analysis, synthesis, comparison, as well as the presentation of tabular and graphical interpretation of statistical information, and time series. The novelty of the article lies in a comprehensive analysis of both regional and national insurance mechanisms in developing countries. Stabilization mechanisms, taking into account the volume of their financial resources, perform significant functions both at the level of the national economy of the member countries and at the regional level, while also influencing the world economy. However, their organizational activities and investment strategy are not always effective, and in this regard, it is advisable to conduct further research in this field.

Keywords:

world finance, sovereign wealth funds, world economy, investments, macroeconomics, national economy, developing countries, Russia, global financial market, COVID-19 pandemic

INTRODUCTION

In terms of the current volatility of the world economy, including the COVID-19 pandemic and escalating geopolitical tension, strengthening the asymmetric interdependence, which enables a less dependent state to establish favourable economic conditions for itself and receive various preferences from a partner to increase its influence by breaking symmetry in financial and economic relations [1], looking into the features of regional and national insurance mechanisms functioning in developing countries is a vital point.

METHODS

The authors use statistical data of ASEAN +3 Macroeconomic Research Office [2], Latin American Reserve Fund [3], Eurasian Fund for Stabilization and Development [4], Ministry of Finance of the Russian Federation [5]. Also, the article is based on the study of foreign and Russian scientific sources. The authors apply general scientific methods of cognition such as analysis, synthesis, comparison, presentation of tabular and graphical interpretation of statistical information and time series.

MAIN PART

In 2000 in response to the Asian financial crisis, the ASEAN +3 ("three" being represented by China, Japan, and South Korea) decided to strengthen their financial cooperation by creating the so-called Chiang Mai Initiative (CMI), which included a network of bilateral swap agreements by the member countries. [6]

The initiative's network of swaps removed political tension but left the funding mechanism brought about great drawbacks. So, the former Minister of Finance of Thailand Chalongphob Sussangkarn called CMI more symbolic than the effective tool. [7]

The CMI was multilaterally transformed into a single contractual agreement called the Chiang Mai Initiative Multilateralisation (CMIM), which came into effect on March 24, 2010. CMIM is a $120 billion multilateral currency swap agreement to support the liquidity of ASEAN+3 member countries.

Its main goals are as follows:

- solving balance of payments and/or short-term liquidity problems in ASEAN+3;

- improving the international financial mechanisms.

Transforming CMI into CMIM is an important milestone, demonstrating the strong member countries adherence to continuous improvement and strengthening financial stability in the region.

The CMIM Agreement parties are the ministries of finance and central banks of the ASEAN+3 countries (Brunei Darussalam, Cambodia, China, Indonesia, Japan, Korea, Lao People's Democratic Republic, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam), as well as the Monetary Hong Kong administration. [8] In 2014 the CMIM Agreement was further strengthened by doubling the size of the credit line to US$240 billion, as well as extending the repayment period and support periods. In addition to the existing CMIM stability facility, the CMIM Precautionary Line was launched. Moreover, the CMIM members have repeatedly confirmed their commitment to the further strengthening of the mechanism.

In March 2021, the CMIM Agreement was amended to increase the share of the swap that could be used outside of the IMF's support program from 30 percent to 40 percent of each member's maximum agreement amount. Thus, the total size of CMIM is 240 billion US dollars.

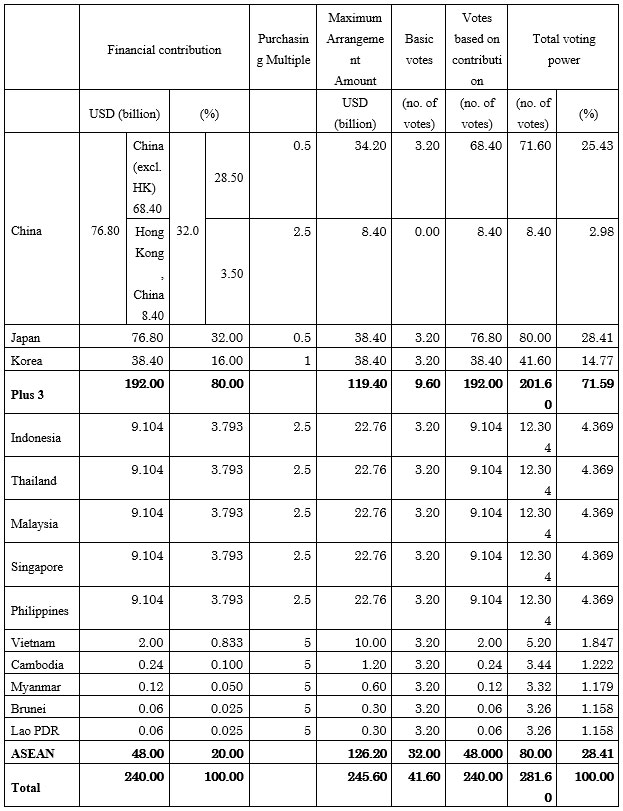

If necessary, any party to the Agreement can count on an amount equal to its contribution multiplied by an individual factor, which is presented in Table 1. So, the ASEAN +3 countries are consistently doing their utmost to protect the region from monetary and financial shocks and reduce dependence (but not non-cooperation) on the global institutions such as the International Monetary Fund (IMF).

Table 1. CMIM contributions, maximum arrangement amount and voting power distribution

Source: [9]

Next, let’s consider BRICS Contingent Reserve Arrangement (CRA). During the Sixth BRICS Summit, which took place in the city of Fortaleza, Brazil, on July 15-16, 2014, the Agreement on the Establishment of the BRICS Reserve Fund was signed. According to the CRA, the financial assistance will be provided to those countries from the BRICS group that are experiencing balance of payments difficulties. In terms of the increased volatility of the world economy and a drastic outflow of capital from developing countries, this decision is very relevant, and the foreign exchange reserves pool being created by the BRICS countries is an important tool for solving similar problems. The volume of the CRA amounted to 100 billion US dollars.

The amount of the contribution has been a matter of dispute since 2012, but the principled approach is that the contribution should correspond to the level of the country's economy, which is the traditional approach. For example, the main donor of the Eurasian Economic Union is Russia. In BRICS, the main financial burden is borne by China, which is the second largest economy in the world and the largest economy of the BRICS group. When distributing funds from the CRA, two main instruments are used, i.e., a preventive one, used to maintain liquidity during a crisis period, and the second one, used to restore the economy in the post-crisis period. At the same time, each country that decides to apply for financial assistance is to substantiate its application, indicating that it is experiencing difficulties related to capital outflows, pressure on foreign exchange markets and a sharp depreciation of the national currency.

The Andean Reserve Fund (FAR), created in 1978 as a Regional Financing Arrangement (RFA) in response to the need of the countries (Bolivia, Colombia, Ecuador, Peru, and Venezuela) to solve problems arising from imbalances in the external sector of the economy and promote the regional integration process. It should be noted that this fund is the second oldest in the world.

In 1989, FAR became the Latin American Reserve Fund (FLAR) due to the interest of the Andean countries in expanding the Andean Reserve Fund (FAR) to Latin America, so Costa Rica, Uruguay and Paraguay joined FLAR in 2000, 2009 and 2015 respectively.

The aims of the Foundation are as follows:

- supporting the member countries balance of payments by providing loans or guaranteeing loans to the third parties;

- improving the conditions for investing in the international reserves of member countries;

- harmonization of the currency, monetary and financial policies of the member countries.

It is essential that FLAR receives deposits from Latin American multilateral institutions, central banks and government agencies of member countries, as well as government agencies of non-member countries. FLAR provides asset management services for government agencies in member countries.

The FLAR is the only RFA that accepts deposits from members and provides asset management services. The FLAR is also the most unconditional in its support, as well as it is a decisive step towards greater macroeconomic stability and regional integration. [10] FLAR has provided more than 50 loans and has also facilitated the integration of some of its member countries into international markets.

FLAR has transformed itself from a reserve pool into a regional financial institution, with both paid-in equity and access to international financial markets in order to raise funds. In addition, FLAR receives deposits from the region's central banks, official institutions and multilateral organizations from member states and non-member countries. The capital structure of FLAR is shown in Table 2.

Table 2. FLAR capital structure as of October 2020

|

Member country

|

Subscribed capital

|

Paid-in capital

|

|

Million of USD

|

Million of USD

|

% Total

|

|

Bolivia

|

328

|

265,8

|

9,9

|

|

Colombia

|

656

|

531,7

|

19,8

|

|

Costa Rica

|

656

|

531,8

|

19,8

|

|

Ecuador

|

328

|

265,8

|

9,9

|

|

Paraguay

|

328

|

265,4

|

9,9

|

|

Perú

|

656

|

531,7

|

19,8

|

|

Uruguay

|

328

|

266,4

|

9,9

|

|

Venezuela

|

656

|

30,7

|

1,1

|

|

Total

|

3938

|

2689,3

|

100

|

Source: [11]

In 2012, the member countries paid in advance the previous subscribed capital and increased it by 40%, confirming their support for this institution.

In 2015, the Central Bank of Costa Rica paid up all its subscribed capital to FLAR ahead of schedule and applied for doubling it in order to achieve the level of "large economic scale countries", which was approved by the Assembly of FLAR representatives.

In May 2015, FLAR agreed a procedure with the International Monetary Fund that its new members must account for a percentage of their paid-in capital as part of their international reserves, which could make it easier for new members to join FLAR.

FLAR's activities are funded by equity contributed by member countries, demand deposits from central banks and other institutions, and debt issued in the capital markets. Its income is generated from interest income and fees on loans to member countries, interest and capital gains on investment portfolios, brokerage income and fees for asset management, and custody services provided to central banks and government agencies.

On July 12, 2021, the FLAR Assembly of Representatives approved the creation of an additional mechanism establishing a category of membership called "associated central bank". Thus, new members of FLAR can fall into two categories of membership: first, the current option of full membership for countries that have joined the founding agreement, and second, the form of an associated central bank through an agreement approved by the Board of Directors and the Assembly of Representatives of FLAR.

Let’s consider the role of FLAR during the coronavirus period. Given the exceptional circumstances created by the COVID-19 pandemic, FLAR has experienced increased demand for loans to support its members' balance of payments. In doing this, the Board of Directors approved of the increase in long-term leverage from 65% to 162% of paid-in capital.

As the COVID-19 pandemic could have lasting effects on the economy, the Board of Directors approved a temporary COVID-19 credit facility with a maturity of up to five years and a grace period of up to three years. As of June 30, 2021, there were no applications for this new credit line. [12]

Next, let’s consider the Eurasian Fund for Stabilization and Development (EFSD), which is a regional financial mechanism (RFF), established on June 9, 2009 to support programs and projects of member countries (Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia and Tajikistan) aimed at maintaining macroeconomic and financial stability, long-term sustainable development and regional integration. RFM is a part of the global financial safety system, which also comprises national protective mechanisms, bilateral swap agreements and international financial institutions.

The EFSD has a capital of US$8.5 billion, contributions to the Fund of US$8.513 billion, and the country breakdown is presented in Figure 1.

Figure 1. The country structure of contributions to the EFSD

Source: [13]

Terms of contributions payment: 10% in cash (in US dollars and/or euros) and 90% in the form of a promissory note, non-negotiable and interest-free promissory note.

EFSD lending is carried out on the principles of repayment and maturity. The EFSD also provides grants to finance social projects of the member states on a non-reimbursable and non-repayable basis. The Fund provides financing only if the borrower has no overdue obligations to the Fund, its member countries and other international financial institutions. All loans are subject to annual access limits proportional to the states' GNI per capita.

Decisions to grant loans to member countries are based on an assessment of:

- the acuteness of the state's need for financing and its solvency;

- long-term debt sustainability of the country;

- the institutional capacity of the borrower to achieve the stated performance indicators for the programs and projects of the EFSD;

- the quality of public administration and the effectiveness of the country's anti-corruption policy (considering the assessments of the World Bank, the IMF and other IFIs).

Financial loans are allocated only to the governments of member countries to support anti-crisis and stabilization programs formulated and implemented by the countries. At the same time, programs should include measures to achieve macroeconomic stability and improve the business climate, ensure long-term development, budgetary and debt sustainability, promote the development of financial and economic cooperation among member countries, and progress in the implementation of reforms is measured by specific indicators and assessed by the Fund Council based on reports. The minimum amount of a financial loan is set at 10 million US dollars. The mechanism for considering an application for financing and making a decision is established by the Procedure for granting financial loans from EFSD funds.

Investment loans are allocated primarily to support interstate integration investment projects (for example, in the field of energy and infrastructure), as well as key national investment projects. Investment loans can be attracted either by companies implementing interstate investment projects or by the countries-members of the Fund. A prerequisite for the provision of investment financing from the EFSD funds is the impossibility of attracting market financing for implementing the project in full, taking into account the project needs, as well as the acceptable risk level.

The procedure for granting investment loans includes the following steps:

- preliminary, which considers the concept of the project and the possibilities for developing a feasibility study;

- final, at which a decision is made on the allocation of an investment loan.

The minimum amount of an investment loan is:

- for countries with a GNI per capita of more than 5 thousand US dollars, it is set at 30 million US dollars;

- for other countries at 10 million US dollars.

The mechanism for considering an investment application and making a decision establishes the Procedure for providing investment financing from the Eurasian Fund for Stabilization and Development.

Next, let’s focus on grants provided for social projects. Since June 15, 2015, the share of the net profit of the Eurasian Fund for Stabilization and Development in the amount of up to 10% annually can be used to provide grants to the Republic of Armenia, the Kyrgyz Republic, and the Republic of Tajikistan.

The grants are provided to finance projects of the participating states in the following social sphere sectors:

- education;

- healthcare;

- efficiency of public administration;

- social security and protection, including food security.

The grants are provided in US dollars and / or euros, while within the framework of one project the amount of the grant can be:

- not less than 500,000 US dollars and not more than 2,000,000 US dollars with an implementation period of up to 1.5 years;

- not less than 2,000,000 US dollars and not more than 5,000,000 US dollars with an implementation period of 1.5 years.

The Fund's project portfolio is 5,395.9 million US dollars, and its structure is presented in Table 3.

Table 3. EFSD project portfolio

|

Status

|

Country

|

Project

|

Sector

|

Date of approval by the Fund Council

|

Mln US dollars

|

|

Implemented

|

Belarus

|

Financial loan #1

|

Balance of payments support

|

02.07.2014

|

2 560

|

|

|

Tajikistan

|

Financial loan #1

|

Budget support

|

18.06.2010

|

70

|

|

|

Belarus

|

Financial loan #2

|

Budget and balance of payments support

|

25.03.2016

|

1800

|

|

|

Tajikistan

|

Financial loan #2

|

Budget support

|

03.07.2015

|

20

|

|

|

Armenia

|

Financial loan #1

|

Budget support

|

29.10.2015

|

300

|

|

Current

|

Armenia

|

Construction of the North-South road, 4th turn

|

Transport

|

02.07.2014

|

150

|

|

|

|

Modernization of irrigation systems

|

Agriculture

|

03.07.2015

|

40

|

|

|

|

Improving the prevention and control of noncommunicable diseases in primary health care

|

Public health

|

28.02.2018

|

1

|

|

|

Kyrgyzstan

|

Reconstruction of a section of the Bishkek-Osh road, 4th phase

|

Transport

|

27.12.2013

|

60

|

|

|

|

Financing the supply of agricultural equipment

|

Agriculture

|

27.12.2013

|

20

|

|

|

|

Rehabilitation of the Toktogul HPP, 2nd phase

|

Energy

|

03.07.2015

|

100

|

|

|

|

Commissioning of the 2nd hydro unit

Kambarata HPP-2

|

Energy

|

23.09.2016

|

110

|

|

|

|

Health caravan

|

Public health

|

29.12.2018

|

2

|

|

At various stages of consideration

|

Armenia

|

Construction of the Mastara reservoir

|

Agriculture

|

09.12.2015

|

25,2

|

|

|

Kyrgyzstan

|

Rehabilitation of Uch-Kurgan hydroelectric power station

|

Energy

|

22.10.2019

|

45

|

|

|

|

Implementation of the security plan

Kambarata HPP-2

|

Energy

|

|

50,7

|

Source: [14]

Features of building national insurance mechanisms based on the example of Russia and Saudi Arabia.

Let’s consider SovereignWealthFunds (SWFs). In some countries they were created as early as the 1950s, but only at the beginning of the 21st century special interest was shown in SWFs. [15] They are investment funds or special purpose vehicles set up by the government for macroeconomic purposes, own and manage assets, including for financial purposes, and use a range of investment strategies, including investing in foreign assets. SWFs are usually created from a positive balance of payments, official foreign exchange transactions, privatization proceeds, budget surpluses, and/or proceeds from the export of goods.

The Saudi Arabia Public Investment Fund (PIF) is one of the largest sovereign wealth funds in the world with total assets of 620 billion US dollar, established in 1971 to invest funds on behalf of the government of Saudi Arabia. The fund, controlled by Crown Prince Mohammed bin Salman, has been ruling Saudi Arabia since 2015. The fund has a world-class investment portfolio with a focus on long-term investments both domestically and internationally. It applies a clear, methodical and professional mechanism in selecting its investment sectors, as it relies on investment policies specific to each sector and defines the investment objectives of its portfolios. These mechanisms also provide necessary information such as eligible assets, targets, key performance indicators and risk tolerance.

The Fund has developed six investment portfolios, four of which are local, two global, after analyzing the assets under its management:

- International Diversified Pool;

- International Strategic Investments;

- Saudi Giga-Projects;

- Saudi Real Estate & Infrastructure Development;

- Saudi Sector Development;

- Saudi Equity Holdings.

Let’s spotlight the sources of PIF financing represented by four main sources: government capital, state assets transferred to PIF, loans and debt instruments, and retained earnings from investments. It should be noted that the fund is also engaged in developing fintech projects. Nowadays, fintech is relevant for almost all types of financial institutions, and the expansion of the financial technologies sphere was based on a strong financial foundation. [16]

The Fund works to stimulate the Kingdom's private sector by investing in new and promising industries that can create jobs, develop potential and allow the national economy to compete regionally and internationally, actively managing its companies, defining and developing strategies and initiatives in a number of economic sectors.

Let’s analyze National Wealth Fund of the Russian Federation (RF), which is a part of the federal budget, is intended to become part of a sustainable mechanism for providing pensions to citizens of the Russian Federation for the long term. The objectives of the National Wealth Fund are to provide co-financing of voluntary pension savings of Russian citizens, as well as to ensure a budget balance of the Russian Pension Fund.

Oil and gas revenues of the federal budget are formed from:

- tax on the extracting minerals in the form of hydrocarbon raw materials, i.e. oil, combustible natural gas, gas condensate;

- export customs duties on crude oil;

- export customs duties on natural gas;

- export customs duties on goods produced from oil.

A certain part of these oil and gas revenues in the form of an oil and gas transfer is annually channelled to finance federal budget expenditures. The amount of the oil and gas transfer is approved by the federal law on the federal budget for the next financial year and planning period in absolute terms, calculated as 3.7% of the volume of gross domestic product (GDP) forecast for the corresponding year, specified in the federal law on the federal budget for the next financial year and planning period.

After the formation of the oil and gas transfer in full, oil and gas revenues go to the Reserve Fund. The normative value of the Reserve Fund is approved by the federal law on the federal budget for the next financial year and planning period in absolute terms, determined on the basis of 10% of the volume of gross domestic product forecast for the corresponding year. When the Reserve Fund is completed to the specified amount, oil and gas revenues are sent to the National Welfare Fund.

From January 1, 2010 to January 1, 2015, the normative value of the Reserve Fund was not determined, the oil and gas revenues of the federal budget are not used to finance the oil and gas transfer and to form the Reserve Fund and the National Welfare Fund, but are channelled to financial support for federal budget expenditures.

Another source of the National Welfare Fund formation is the income from the management of its funds.

From January 1, 2010 to February 1, 2015, income from the management of the funds of the National Welfare Fund is not credited to the Fund, but is flowed to financial support for federal budget expenditures. Oil and gas revenues from the federal budget, the Reserve Fund and the National Welfare Fund are accounted for in separate accounts for the federal budget funds opened by the Federal Treasury with the Central Bank of the Russian Federation.

From January 1, 2010 to January 1, 2015, separate accounting of oil and gas revenues of the federal budget is not carried out. Funds’ transfers in connection with forming and using oil and gas revenues of the federal budget, oil and gas transfers, the resources of the Reserve Fund and the National Wealth Fund are carried out by the Ministry of Finance of the Russian Federation according to the order established by the Government of the Russian Federation.

From January 1, 2010 to January 1, 2015, the procedure for conducting settlements and transfers of funds in connection with the formation and use of oil and gas revenues from the federal budget, oil and gas transfers, funds from the Reserve Fund and the National Welfare Fund has been suspended.

Accounting for transactions of oil and gas revenues of the federal budget, funds of the Reserve Fund and the National Wealth Fund is carried out according to the order established for the accounting of federal budget funds transactions.

The management of the funds of the National Wealth Fund can be carried out in the following ways (individually and simultaneously): [17]

1) by acquiring foreign currency at the expense of the Fund and placing it on the accounts of the National Wealth Fund in foreign currency (US dollars, euros, pounds sterling) at the Central Bank of the Russian Federation. For the use of funds on these accounts, the Central Bank of the Russian Federation pays the interest established by the bank account agreement;

2) by placing the Fund's resources in foreign currency and financial assets denominated in Russian roubles and permitted foreign currency, i.e. permitted financial assets.

The Ministry of Finance of the Russian Federation manages the funds of the National Wealth Fund in accordance with the first method, namely, by placing funds in foreign currency accounts with the Central Bank of the Russian Federation in the following way. According to the procedure for calculating and crediting interest accrued to the accounts of the National Wealth Fund in foreign currency, approved by the Ministry of Finance of the Russian Federation, the Bank of Russia pays interest on the balances on these accounts equivalent to the yield of indices formed from financial assets into which the Fund's funds can be placed national welfare, the requirements for which are approved by the Government of the Russian Federation.

Let’s consider the rules of investing. The Government of the Russian Federation sets the maximum share of permitted financial assets in the total amount of placed funds of the National Welfare Fund. In order to improve the efficiency of managing the funds of the National Wealth Fund, the Ministry of Finance of the Russian Federation is authorized to approve the regulatory shares of permitted financial assets in the total amount of placed funds of the National Wealth Fund within the appropriate shares established by the Government of the Russian Federation, presented in Table 4.

Table 4. Shares of permitted financial assets in the total amount of placed resources of the National Wealth Fund.

|

Permitted financial assets based on the Budget Code of the Russian Federation

|

Limit shares established by the Government of the Russian Federation

|

Regulatory shares approved by the Russian Ministry of Finance

|

|

foreign currency

|

rubles

|

|

debt obligations of foreign states

|

0-100 %

|

90 %

|

0 %

|

|

debt obligations of foreign government agencies and central banks

|

0-30 %

|

0 %

|

0 %

|

|

debt obligations of international financial organizations, including those issued in securities

|

0-15 %

|

0 %

|

0 %

|

|

deposits and balances on bank accounts in banks and credit institutions

|

0-40 %

|

0 %

|

0 %

|

|

deposits in the group of state corporation "Bank for Development and Foreign Economic Affairs (Vnesheconombank)"

|

0-40 %

|

10 %

|

100 %

|

|

deposits and balances on bank accounts in the Central Bank of the Russian Federation

|

0-100%

|

|

|

|

debt obligations of legal entities

|

0-30 %

|

0 %

|

0 %

|

|

shares of legal entities and shares (participatory interests) of investment funds

|

0-50 %

|

0 %

|

0 %

|

Source: [18]

The resources from the National Wealth Fund can be used to co-finance the voluntary pension savings of Russian citizens and to ensure a balance (covering the deficit) of the budget of the Pension Fund of the Russian Federation. The amount of resources from the National Wealth Fund allocated for these purposes is established by the federal law on the federal budget for the next year and planning period.

The procedure for co-financing voluntary pension savings of citizens of the Russian Federation is defined in the Federal Law of April 30, 2008 No. 56-FZ “On additional insurance premiums for the funded part of labour pension and state support for the formation of pension savings”.

Figures 2 shows the dynamics of the volume of the National Wealth Fund in billion US dollars and as a percentage of Russian GDP.

Figure 2. Volume of the National Welfare Fund of the Russian Federation in billion US dollars and as a percentage of GDP

Source: [19]

It should be noted that in early June 2021, the Ministry of Finance of the Russian Federation, together with the Bank of Russia, decided to change the composition of investments of the NWF funds in foreign exchange assets with the complete exclusion of the US dollar from their structure. The next step may be a further reducing the share of the US dollar in the international foreign exchange reserves of the Bank of Russia. [20]

CONCLUSION

In XX century the regional and national insurance mechanisms in developing countries were actively developed and adopted new forms, and today they have become very powerful financial institutions focused on investment in innovative industries and an effective form of long-term money for the implementation of strategic goals in the field of economic development. Apart from that, it can be positively assessing the implementation of such a goal as international financial integration based on the strengthening of economic relations among emerging markets.

One of the arguments in favour of regional and national insurance mechanisms is that countries eligible to receive resources have more decision-making power to influence the policies and instruments, and it leads regional and subregional mechanisms to respond more readily to the demand of member countries. [21]

The Russian practice of organizing and managing national insurance mechanisms has differences, with the active use of funds to cover the budget deficit, but an insignificant investment potential. It should be noted that Russian funds do not use long-term investments and are not used as a tool for the implementation of strategic macroeconomic objectives.

In the time of instability of the global financial system and national economies, regional and national insurance mechanisms play an important role. On the one hand, their activities as investors contributes to the solution of problems with the liquidity and investments, on the other hand, having accumulated significant financial resources, the mechanisms are able to fulfil their stabilization function in the national economy. However, their organizational activities and investment strategy are not always effective, and in this regard, it is advisable to conduct further research in this field.

ACKNOWLEDGMENTS

The article was written based on the results of the research carried out at the expense of budget funds, which were provided to the Financial University as part of the state contract.

References

1. Ozarnov, R.V. (2020). Asymmetric interdependence as a basis for financial and economic cooperation in modern conditions. Nauchnoe obozrenie: teoriya i praktika [Scientific Review: Theory and Practice], vol. 10, iss. 8. pp. 1477-1488 (in Russian). DOI: 10.35679/2226-0226-2020-10-8-1477-1488

2. ASEAN +3 Macroeconomic Research Office https://www.amro-asia.org/ (accessed: 08.07.2022)

3. Latin American Reserve Fund https://flar.com/ (accessed: 15.07.2022)

4. Eurasian Fund for Stabilization and Development https://efsd.eabr.org/ (accessed: 20.08.2022)

5. Ministry of Finance of the Russian Federation https://minfin.gov.ru/ (accessed: 25.04.2022)

6. Artner, Annamaria. “ROLE OF INDONESIA IN THE EVOLUTION OF ASEAN.” The Journal of East Asian Affairs, vol. 31, no. 1, 2017, pp. 1–38. JSTOR, http://www.jstor.org/stable/44321271 (accessed: 20.08.2022)

7. JOHN D. CIORCIARI. “Chiang Mai Initiative Multilateralization: International Politics and Institution-Building in Asia.” Asian Survey, vol. 51, no. 5, 2011, pp. 926–52, https://doi.org/10.1525/as.2011.51.5.926 (accessed: 16.04.2022)

8. Mieno, Fumiharu. “‘Missing Links’ in the Financial System in ASEAN: Future Challenges in Regional Financial Cooperation.” FINANCIAL COOPERATION IN EAST ASIA, edited by Tomoo Kikuchi and Masaya Sakuragawa, S. Rajaratnam School of International Studies, 2019, pp. 27–35. JSTOR, http://www.jstor.org/stable/resrep25423.6 (accessed: 22.08.2022)

9. ASEAN +3 Macroeconomic Research Office https://www.amro-asia.org/wp-content/uploads/2021/08/CMIM-Datable.jpg (accessed: 10.07.2022)

10. Medhora, Rohinton P. “MONETARY UNIONS, REGIONAL FINANCIAL ARRANGEMENTS, AND CENTRAL BANK SWAP LINES: BYPASSES TO THE INTERNATIONAL MONETARY FUND?” AJIL Unbound, vol. 111, 2017, pp. 241–313. JSTOR, https://www.jstor.org/stable/27003738. (accessed: 05.08.2022)

11. Latin American Reserve Fund https://flar.com/en/about-flar/capital-structure (accessed: 20.07.2022)

12. Latin American Reserve Fund https://flar.com/sites/default/files/2022-01/Financial%20Statements%202021%20June.pdf (accessed: 20.07.2022)

13. Eurasian Fund for Stabilization and Development https://efsd.eabr.org/about/ (accessed: 21.08.2022)

14. Eurasian Fund for Stabilization and Development https://efsd.eabr.org/about/ (accessed: 21.08.2022)

15. Rezervnyy fond i Fond natsional'nogo blagosostoyaniya Rossii v mezhdunarodnoy sisteme suverennykh fondov, A. V. Navoy, L. I. Shalunova, Den'gi i kredit, ¹2, 2014

16. Medvedeva M. B. Mirovaya finansovaya industriya v usloviyakh tsifrovizatsii / Medvedeva M. B. // Bankovskie uslugi. – 2020. – ¹ 7-8. – S. 3–10. – DOI: 10.36992/2075-1915_2020_7-8_3

17. Ministry of Finance of the Russian Federation https://minfin.gov.ru/ru/perfomance/nationalwealthfund/management/ (accessed: 28.05.2022)

18. Ministry of Finance of the Russian Federation https://minfin.gov.ru/ru/perfomance/nationalwealthfund/management/ (accessed: 25.05.2022)

19. Ministry of Finance of the Russian Federation https://minfin.gov.ru/ru/perfomance/nationalwealthfund/statistics/ (accessed: 20.09.2022)

20. Pishchik V. Ya. Faktory sodeystviya povysheniyu konkurentosposobnosti rossiyskogo rublya v mezhdunarodnom oborote / Pishchik V. Ya. // Bankovskie uslugi. – 2021. – ¹ 6. – S. 2–8. DOI: 10.36992/2075-1915_2021_6_2

21. OCAMPO, JOSE ANTONIO, and DANIEL TITELMAN. “Subregional Financial Cooperation: The South American Experience.” Journal of Post Keynesian Economics, vol. 32, no. 2, 2009, pp. 249–68. JSTOR, http://www.jstor.org/stable/40599719 (accessed: 06.09.2022)

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.