|

DOI: 10.25136/2409-7802.2023.1.39829

EDN: AAZOQL

Received:

21-02-2023

Published:

29-03-2023

Abstract:

Bank lending to small and medium-sized enterprises is an established and integral element of Russia's market economy. Over the past three years there has been a positive trend in the development of bank corporate lending, including the introduction into national practice of a new form of asset-based lending (ABL). Scientific works of Russian and foreign economists and lawyers were used as materials for the study. The study was based on the statistical database of the Central Bank of the Russian Federation and the statistics of the national project «Small and Medium Entrepreneurship and Support of Individual Entrepreneurial Initiative». We used general methods of scientific knowledge: methods of empirical (comparison, observation) and theoretical (analysis, synthesis) research to study the main indicators of the lending (financing) market for small and medium enterprises (the dynamics of the volume of loans, the dynamics of the number of loans, the dynamics of the number of SMEs receiving credit, the dynamics of debt on loans granted to SMEs, including overdue). The applied research methods allowed us to analyze the SME lending market and identify the main factors affecting the SME lending market in Russia - high interest rates, as well as the growth of overdue loans. Share of overdue loans has averaged 10-15% in different reporting months over the past two years (the analyzed period from April 2019 to April 2021). This study examines current trends in lending to SMEs in Russia, especially the emergence of ABL, which have been underrepresented in recent literature. Recommendations are developed to increase the share of asset-based lending, as well as to increase its volume. The materials of the study can be useful to scholars dealing with this issue, government regulators, as well as commercial banks (including banks with state participation) and factoring finance companies.

Keywords:

asset-based lending, small enterprises, credit instruments, credit market, corporate credit, non-bank financial institutions, economic policy, banking activities, banks, financial market

Introduction

The importance of the small and medium-sized enterprises (SMEs) sector is recognized worldwide. SMEs, in aggregate, are the biggest employer in most countries, accounting for about two thirds of all employment in the UK, and an even greater proportion in Germany and Japan (Mkhaiber and Werner, 2021). A number of studies confirm the positive relationship between the relative size of the SME sector, the well-being of the population, and economic growth (Bijkerk and De Vries, 2019). In addition, the growth in the number of SMEs leads to increased competition in the economy. Companies with low-productivity are leaving the market, while companies with high-productivity are growing, leading to an increase in the overall productivity of the economy and an increase in the income of the population. Competition also leads to an increase in the quality of goods and services. The important role of the state, in particular banks and non-bank financial institutions with state participation, in asset-based SME financing (ABL financing) is certainly to create relevant trends for the entire financial services market in Russia in the next 3-5 years.

It should be recognized that the criteria for classifying manufacturing enterprises as SMEs vary at the national level. Therefore, it is necessary to clarify which legal entities can be classified as SMEs in Russia.

The general criteria for SMEs in 2023 are:

the limiting value of the average number of employees for the previous calendar year: 15 people - for microenterprises; 16-100 people - for small businesses; 101-250 people - for medium-sized enterprises;

income for the year in accordance with the rules of tax accounting does not exceed: 120 million rubles - for microenterprises; 800 million rubles - for small businesses; 2 billion rubles - for medium-sized enterprises.

For certain organizational-legal forms of legal entities (limited liability company, business partnership, joint-stock company), additional criteria may be established by law.

The Federal Tax Service of the Russian Federation (FTS of Russia) maintains the Unified Register of subjects of small and medium-sized enterprises (https://rmsp.nalog.ru/). The Register is formed automatically on the basis of the tax reporting data which the organization or individual entrepreneurs submitted to the tax authorities for the previous calendar year from July 1 to July 5 in the form of electronic documents signed by an enhanced qualified electronic signature, using the official website of the Federal Tax Service of Russia in the «Internet». The data provided are updated by the tax service annually on August 10. The information is posted on the 10th day of each month if the specified conditions are met by the companies and is publicly available for 5 years. Such types of information as newly established or terminated legal entities, updating names, addresses and licenses, manufactured products and participation in procurement - are updated every 10th day of every month. So, as of July 10, 2021 in Russia 5 622 914 SMEs produce 8489 types of products and services. SMEs employ 14,623,221 people.

The register is maintained by the tax service to reduce the costs of entrepreneurs associated with the need to confirm the status of a small and medium-sized enterprise; implementation of «supervisory vacations»; improving the quality of support measures; maximum disclosure of information about the activities, goods and services produced by small and medium-sized businesses. Newly created organizations and individual entrepreneurs send an application for registration using a special service of the Federal Tax Service of Russia. The unified register is a guarantee of legal activity of the entrepreneur in front of partners, suppliers, buyers, or bodies which give subsidies. The category of the enterprise changes if during three years the income and number of employees have not reached the limits stated in part 4 article 4 of the Federal law from 24.07.2007 ¹ 209-FL «About development of small and medium business in the Russian Federation». Organizations that failed to submit to the Federal Tax Service of Russia information on the number of employees or tax returns for the previous year are excluded from the register.

Despite the fact that at the level of the state some measures are taken for the formation and development of entrepreneurial activity in Russia, it should be stated that in 2019-2021 the development of SMEs has slowed down. One such measure is preferential lending to SMEs in commercial banks. Thus, Decree ¹ 1764 of the Russian Government of December 30, 2018, approved the Rules for granting subsidies to Russian credit institutions to reimburse their shortfalls in income on loans extended to SMEs at a preferential rate in 2019-2024. The upper limit of the size of loans for investment purposes is 2 billion rubles in all sectors (types of activities). In addition, fixed subsidy rates for loans issued by authorized banks under the subsidy program are set at 3.5% for loans issued to small businesses and medium-sized enterprises - participants in regional programs (project) to increase productivity, and at 3% for loans to medium-sized enterprises. This makes it possible to include in the subsidy program loans with the full rate of 12%.

The Russian Government has taken measures in the SME lending sphere due to the difficult economic situation in Russia after restrictions caused by COVID-19. Decree ¹ 2425 of the Russian Government of December 31, 2020, approved new rules under which the maximum rate should not exceed the key rate of the Central Bank, increased by 2.75%. As of December 31, 2020, it was 4.25%, hence, the rate on concessional loans for SMEs must not exceed 7% per annum (4.25% + 2.75%). Prior to that, the rate on concessional loans was at the level of 8.5%. This measure was extended to SMEs and persons who pay tax on professional income (the so-called «self-employed»). There are a number of mandatory requirements that must be met in order to receive a loan on preferential terms. Firstly, the purpose of the loan is for investment purposes, refinancing and replenishment of working capital. Second, registration in the unified register of SMEs is required in order to obtain a preferential loan. Thirdly, loans are granted to those who work in priority sectors of the economy, including: agriculture, retail and wholesale trade, domestic tourism, restaurant business, science and technology, health and education, manufacturing industry, consumer services.

In these circumstances, when the possibilities of traditional lending to SMEs are objectively exhausted, ABL of purchases from SMEs based on the assessment of assets has a number of advantages. At the same time, there is a set of legal and economic peculiarities of ABL implementation in Russia.

Literature Review

Many authors study the relationship between the economic policy of the national government and the market for lending to SMEs (Soininen et.al., 2012). In particular, Japanese economists have analyzed the loan guarantees provided by the Japanese government for bank loans to SMEs and assessed to what extent and under what conditions loan guarantees affect banks' risk taking and non-guaranteed bank lending (Wilcox et.al., 2019). Aysan with co-author examined whether banks' credit supply to SMEs are affected by their financial conditions (Aysan et.al., 2019). Given the importance of SMEs to the economy, Abbasi et. al. (2020) investigated whether peer-to-peer (P2P) lending financial technologies (Fintechs) enhance the SMEs’ access to finance.

Today almost no company can grow without raising money from external sources. Foreign economists note that small firms are largely dependent on bank credit for external funding (Mkhaiber et.al, 2021). In terms of its role in the economy, entrepreneurship in Russia is inferior to many countries, including the United States, Ireland, Japan, Italy, etc.

The main priorities for the development of the sphere of entrepreneurship in Russia include improving the conditions for doing business, simplifying tax reporting, access to concessional financing, and improving the procurement system and others. Among the negative aspects of state regulation that hinder the development of small and medium-sized businesses, administrative barriers can be singled out (Bikeeva et.al, 2020).

The state and the problems of the small business system in the Russian Federation are primarily associated with its financial conditions. Insufficient rate of small business growth relates to a variety of causes, including lack of availability of the long-term lending resources. Small business lending conditions need state-financing backing (Sabitova et.al., 2015). Burov systematized approaches to the classification of factors in the SME lending process in Russia, highlighting the shortcomings of the approaches, including: limited representation of the lending process, insufficient consideration of the impact of tax and financial environment, taking into account the characteristics of obtaining credit in a developing economy (Burov, 2020).

A review of the Russian literature shows that the observed in the Russian economy phenomena of stagnation in the SME segment in recent years predetermine the importance of supporting the development of the sector at the legislative level, as well as improving the mechanism of SMEs' access to borrowed credit resources from banks and factoring financial companies with state participation. State regulation and support for SMEs, in particular the program of subsidizing bank interest rates, which we discussed in the introduction did not produce the expected qualitative tangible result. Ushanov identified the reasons for the inaccessibility of the above-mentioned loans under the program of subsidizing bank rates: first, the difficulty for banks with a basic license in building a sustainable model of lending to small businesses; second, the lack of development of the SME sector in Russia as a result of a number of constraining factors (Ushanov, 2020). These circumstances have determined the search by progressive market participants for new approaches to financing purchases from SMEs based on asset valuation (ABL financing).

Survey results

State and Dynamics of SME Lending in Russia in 2020-2021. The availability of finance required for development and growth is one of the most common and significant problems in SME functioning (Razumovskaia et.al, 2020). The peculiarity of the development of the production sphere is the gap between the investments made and the output of finished products. This factor contributes to attraction of external sources of financing of production activity. The system of traditional crediting of production enterprises by commercial banks, or financing of purchases through assessment of assets (ABL financing) by factoring (non-banking) financial organizations with state participation allows to solve this problem. At the same time, there are a number of difficulties in solving the issues of traditional crediting of production enterprises.

In the current socio-economic situation in Russia, complicated by the ongoing pandemic of a new coronavirus infection, the institutional measures to support SMEs are the reduction of interest rates, increasing the availability of credit. A reduction in the weighted average interest rate on loans to 5-6% per annum will result in the significant growth of lending to the real sector. The government should also soften regulatory measures or cover some costs by providing guarantees to banks (Kulikov et.al., 2021). Unstable financial condition of SMEs, other economic problems of production enterprises require a special competent approach in the development of programs and directions of financing of the production sphere, by the example of which we will further consider the current tools of legal regulation of corporate risk assessment procedures and the role of the government in their improvement.

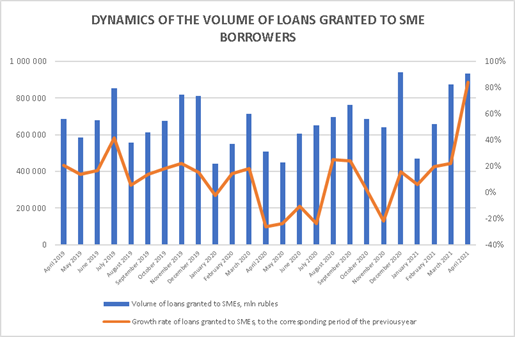

According to the Bank of Russia, the volume of traditional loans extended to SMEs in May 2021 amounted to 766.3 billion rubles, which is by 18% less than in April, but by 71.3% more than a year earlier. SMEs were granted 143,737 loans (a decrease of 7.0% as compared with April 2021), the number of SME borrowers who received credit amounted to 129,248, having decreased by 5.6% for the month. At the same time, the value of both indicators exceeded the values of May of the previous year by 29.7 and 31.2%, respectively.

The average loan size of SME borrowers in May 2021 decreased as compared with the previous month by 0.7 million, to 5.3 million rubles, but was higher than in May 2020 (4 million rubles). By comparison, the average loan size of non-SME borrowers in May was equal to 371.3 million rubles.

In the structure of loans granted to SMEs in May 2021 the largest share belonged to borrowers operating in the following industries: «wholesale and retail trade; repair of motor vehicles and motorcycles» - 42.0%, «manufacturing industries» - 14.9% and «professional, scientific and technical activities»- 9.1%.

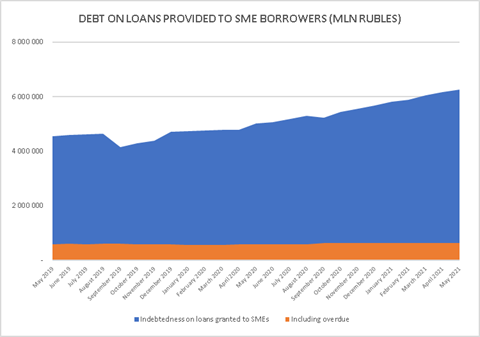

Debt on credits granted to SME as of 01.06.2021 amounted to 6,437.5 billion rubles, having increased over the month by 185.3 billion rubles (by 2.9%). The annual growth rate of indebtedness on credits to SME as of 01.06.2021 increased to 27.2%, which was the highest since the beginning of the year. The share of indebtedness under SME credits in the total amount of indebtedness under credits of legal entities and private entrepreneurs as of 01.06.2021 amounted to 16.6%.

In the industrial structure of debt as of 01.06.2021 dominated «Real estate operations» - 20.3%, «Wholesale and retail trade; repair of motor vehicles and motorcycles» - 16.4%, «Manufacturing» - 13.2%.

The number of SME borrowers in May 2021 slightly increased compared to the previous reporting date, halting the downward trend of the last two months.

Pic. 1. Dynamics of the volume of loans granted to SME borrowers.

As of 01.06.2021 a total of 353,316 SMEs have loans (14.6% more than a year before). The share of borrowers in the total number of SMEs as of 01.06.2021 amounted to 6.1%, which is 1 percentage point (p.p.) more than as of 01.06.2020. Overdue debt of SMEs as of June 1, 2021 amounted to 643.1 billion rubles, having decreased by 1.6 billion rubles. (by 0.2%). Overdue indebtedness is registered in 37,950 borrowers, which amounts to 10.7% of the total number of SME borrowers.

Another problem requiring resolution is overdue indebtedness of SMEs on loans, which in the long term deprives the enterprises which have incurred indebtedness of access to new loans.

Pic. 2. Debt on loans provided to SME borrowers.

As of June 1, 2021, the share of overdue indebtedness in the total amount of SME loans decreased slightly and amounted to 10.0% (for comparison, 11.6% as of July 1, 2020). At the same time, it remains almost twice as high as the similar indicator of overdue debt on loans to non-SME borrowers (as of June 1, 2021 - 5.1%).

In May 2021 weighted average interest rates on loans granted to SMEs slightly increased as compared with April 2021: short-term loans (up to 1 year) - by 0.08 p.p., to 8.35% per annum, long-term loans (for a period over 1 year) - by 0.23 p.p., to 7.69% per annum. The level of interest rates in May 2021 remained significantly lower than in May 2020 (by 1.39 p.p. on short-term loans, and by 1.74 p.p. on long-term loans).

In May 2021, the spread between interest rates on SME loans on short-term loans amounted to 2.17 p.p., on long-term loans - 0.73 p.p. (in May 2020 this indicator was 2.78 and 1.68 p.p., respectively). (in May 2020 this indicator was 2.78 and 1.68 p.p., respectively).

State of SME lending in Russian regions in 2020-2021

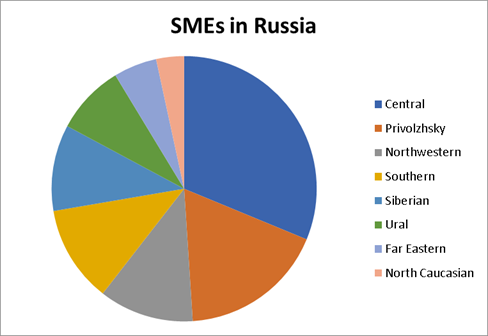

The Russian Federation is divided into federal districts (Central, Privolzhsky, Northwestern, Southern, Siberian, Ural, Far Eastern, and North Caucasian), and the SMEs operating in them are unevenly distributed across the country.

Pic. 3. Distribution of SME by Federal Districts of Russia (as of July 10, 2021).

According to the statistics of the Bank of Russia, the largest volume of loans in May 2021 was granted to borrowers - SMEs of the Central Federal District - 310.6 billion rubles (twice as much as a year earlier), including borrowers of Moscow - 197.5 billion rubles.

The annual growth rate of indebtedness on loans to SMEs as of 01.06.2021 was positive in all federal districts, except the North Caucasian Federal District, where indebtedness on loans on this date decreased by 1.29%. The most significant increase in indebtedness on loans to SMEs was observed in the Northwestern Federal District (growth rate - 68.8%).

Not all SME borrowers repay their loans in good faith. The data on overdue indebtedness are also distributed unevenly across federal districts. The lowest share of overdue indebtedness in the total amount of SME loans was observed in the Urals Federal District (6.27%), the highest share - in the North Caucasian Federal District (15.73%). The maximum share of SME debt in the total amount of debt of legal entities and individual entrepreneurs was observed in the Republic of Adygea (78.6%) and the city of Sevastopol (73.6%), the minimum - in the Nenets and Yamalo-Nenets Autonomous Districts (less than 2.2%).

Asset-Based Lending in Russia: Theory and Practice

Banks commonly use ABL to provide loans collateralized by a borrower firm’s inventory (Alan et.al, 2018). The largest lenders to SMEs in Russia today are the following commercial banks with state participation: Sberbank, VTB Bank, Otkrytie Bank, Rosselkhozbank, Promsvyazbank. However, the market for lending in Russia is fairly narrow compared to European, American and Chinese banking products. For example, Sberbank offers SMEs only standard credit offers and factoring.

Another no less important problem of traditional SME lending is the significant share of overdue debts, the share of which over the past two years (the analyzed period from April 2019 to April 2021) has averaged 10-15% in different reporting months. The statistics reflect the lack of opportunities for a significant part of SMEs to repay their debts.

In addition to the problems faced by SMEs, there has been a transition of the Russian economy to platform models and ecosystems along with the rest of the world. The system of ecosystems operates according to the one-window rule, which is a convenient advantage for the user. Such systems tend to provide both financial and non-financial services simultaneously. Regulators' policy towards ecosystems is now in the active formation stage. However, already now the Central Bank of the Russian Federation notes significant risks of this model. Financial organizations, which are experts in providing financial services, assume operational risks in which they have no relevant competencies. As a result of ineffective risk management both lines of business are affected. The stability of financial institutions in such a concept is violated (Central Bank of the Russian Federation, 2021).

One solution to the current economic situation is ABL (asset-based lending), which is not yet widely accepted in Russia, but is widespread in the United States and the European Union. This instrument combines the attributes of factoring with the distinction that a financial organization becomes a participant in a special purpose vehicle (SPV) with the borrower.

SPV takes the form of the project and is responsible for its construction, development, operation and administration, also pays the financing credit with the project's cash flow and ensures compliance with this obligation with their property (Fonseca, 2015). Being the participant of SPV, a financial non-banking organization does not grant financing against the pledge of assets, but becomes their owner. Thus, it gains control over the movement of commodity and cash flows, the ability to continuously monitor the operating activities of the SPV and its assets, significantly increasing the speed of decision-making and reducing credit risks.

By becoming an SPV member, a financial institution becomes a member of an operating business with a mature risk management system in place. This fact allows SPV members to combine competencies in operational and financial risk management and build an even more stable system in the organization. This method can be recognized as a qualified approach to risk mitigation in the ecosystems of large banks and financial institutions with state participation.

One of the small number of non-banking financial institutions in Russia providing ABL is VTB Factoring (a company with dominant state participation). In this case, the presence of the state in the founders is positively reflected in the company's ability to test new economic instruments and hypotheses. The non-standard approach to securing financing includes a condition on VTB Factoring's confirmation of the quality of functioning of risk-oriented management of procurement processes (including from SMEs) and management of inventories in the SPV partner company. This condition is caused by the mutual responsibility for risks of both the legal entity and the financial institution.

The maturity of the risk-oriented management system affects, among other things, the funding rate. For companies that effectively manage their own risks, the funding rate can be reduced from 0.5 to 1 percentage point. As part of SME working capital, this fact provides significant savings for the company.

The current Russian legislation establishes the obligation of joint stock companies (Federal Law ¹ 208-FL «On Joint Stock Companies» from 26.12.1995) and banks (Federal Law ¹ 395-1 «On Banks and Banking Activities» from 02.12.1990) to organize risk management and internal control. These strict requirements do not apply to non-banking institutions, however, in the case of ABL a financial institution is interested in cooperation with a counterparty with a developed risk management culture and, accordingly, has appropriate requirements for it. Before approving an ABL transaction, a financial institution requests a number of documents confirming the existence of an effective system of local regulations for risk management, as well as analyzes the financial statements and operations of the potential partner in general.

One of the most significant issues for the risk management system analysis is the procedure of checking (accrediting) counterparties of a non-financial organization, especially SMEs, for compliance with anti-money laundering legislation. Detailed requirements for organizations carrying out operations with money and property are specified in the Federal Law dated 07.08.2001 ¹ 115-FL «On Anti-Money Laundering and Terrorism Financing». Under the requirements imposed by the State, organizations performing operations with money or property must organize internal control. Besides, the said law contains a prohibition on informing clients and other persons about the measures taken within the framework of combating legalization (laundering) of criminal incomes.

While these requirements apply only to certain categories of SMEs, tax risks are inherent to any organization engaged in commercial activities. In order to minimize this risk, an effective solution is to conclude a service agreement with Interfax Information Agency, which provides its clients with up-to-date information on the status of a legal entity, its financial statements and risk level. As of June 2021 the SPARK system created by the agency contains information about 3.42 million legal entities and 3.55 million individual entrepreneurs. The system accumulates all available data about the companies: information about payment discipline of the companies, information about foreign legal entities, mass media materials, data from credit bureaus, notary, Federal Service for State Registration, Cadastre and Cartography. Moreover, the system automatically informs about the changes in counterparty's status in order to take risk-based decisions in real time. In other words, the use of this system allows to minimize the risks of contracting with unreliable counterparties. According to a Deloitte survey, 71.5% of large and medium-sized companies in Russia use this system to check the trustworthiness of partners.

The other most significant risk is administrative prosecution for violations of legislation regulating the processing of personal data. In order to minimize the risk of being held administratively liable, both financial institutions and non-financial organizations request consent from counterparties and employees to process personal data. By signing such consent, the other party agrees to the collection, recording, systematization, accumulation, storage, clarification (updating, modification), extraction, use, transfer (distribution, provision, access), anonymization, blocking, deletion and destruction of personal data.

After confirming the maturity of the non-financial company's risk management system, as well as calculating the economic feasibility of the transaction, the willingness of the two parties of SPV to enter into a civil legal relationship is confirmed.

The external form of expression of this willingness is a corporate agreement. The agreement between the participants (shareholders) of the company as a tool of corporate governance is widely used in foreign practice (Kaldybayev 2021). A corporate contract's legal structure exists in two versions: Anglo-American and continental, which entails legal regulation peculiarities. In the first case, it has a special regulation, in the second, it is subject to the general provisions of civil law, including the law of obligations (Korobeinikova 2021).

In Russia the corporate agreement is not yet fully used, although it can provide a flexible and tailored regulation between company participants, between participants and third parties, and the company itself. In the post-Soviet space Russia is one of the few countries where a progressive legal mechanism for regulating corporate relations has already been created. In 2014 a rule of paragraph 1 of Article 67.2 of the Civil Code of the Russian Federation was introduced which gives shareholders of business companies the right to conclude between themselves a corporate agreement on exercising their corporate rights. Under Russian legislation, a corporate agreement is an agreement on various issues of exercising corporate rights concluded between the participants of a business entity or other persons who have the right to be a party to a corporate agreement under the legislation (Korobeinikova 2021).

Pursuant to the corporate agreement, the parties undertake to exercise their rights in a certain manner or to refrain (waive) from exercising them, including voting in a certain manner at a general meeting of members of the company, concertedly performing other actions to manage the company, acquiring or alienating shares in its authorized capital (stock) at a certain price or upon the occurrence of certain circumstances or refraining from alienating shares (stock) until certain circumstances have occurred.

Russian law enforcers, especially judges, in the first year of these civil law norms were wary of the new mechanism for regulating corporate relations. As a consequence, in 2015 the highest judicial body of Russia gave explanations on their application in practice. In the Resolution of the Plenum of the Supreme Court of the Russian Federation of 23.06.2015 ¹ 25 «On application by the courts of some provisions of section I of part I of the Civil Code of the Russian Federation», in particular it is explained: «According to paragraph 7 of article 67.2 of the Civil Code the parties of the corporate contract have no right to refer to its invalidity in connection with its contradiction to provisions of the charter of an economic society. In this case a party to the corporate agreement does not lose the right to claim against the other party based on such an agreement» (clause 37). In other words, the corporate agreement has priority for its parties over the constituent documents of companies (articles of association, foundation agreement). As can be seen from the explanations, Russia's highest court emphasizes the freedom of contract and the autonomy of will of the parties to a corporate contract, which may include in their contract those provisions which they consider important and necessary to ensure and protect their rights and interests and achieve their legitimate goals, including on issues of ABL.

Results discussion

The analysis of the statistical data presented in the study allows us to predict a further increase in the volume of financing of goods purchases from SMEs by ABL. At the same time, the above-mentioned problems of traditional lending to SMEs in Russia indicate the need to find new forms of investment in purchases from SMEs, which can provide access to financing without sureties, administrative barriers and on more favorable terms. In the current economic situation and quite bureaucratic procedures for obtaining loans under state programs of concessional subsidies, the experience of ABL in financing procurement of goods (including from SMEs) with participation of VTB Factoring (company with state participation) and group of companies SALAIR (private company) in 59 subjects of Russia in 2020-2021 should be considered positive.

The interaction of these companies is based on the synergy of standards of VTB Factoring, group of companies SALAIR and the best international and Russian practices, which ensures a high level of transparency and predictability of business for SPV members.

This partnership occurred largely as a result of preliminary work involving academic science in the field of risk management. As part of the preparatory phase, the risk management system was transferred from the state of reacting to incidents to the stage of predictive analysis of potential risks. By automating core business processes, transparency and manageability of the system as a whole were achieved. The target state of the system is achieved through the developed IT markers, which are indicators of risk events. Thus, any deviation from the standard can be promptly identified and risks inherent in this deviation minimized, or planned corrective measures can be taken.

ABL, i.e. payment for purchases from SMEs based on a pledge of goods in an SPV company, should be recognized as a promising source of financing for SMEs not only in Russia, but also in China. This instrument has a number of advantages over standard credit offers and traditional factoring, among them: no need for a guarantee, no debt on the borrower, no covenants.

A distinctive feature of ABL is the mutual responsibility of the borrower and the financial institution based on a risk-oriented approach to managing the process of involving goods purchased from SMEs into production within the period agreed by the parties (usually 90, 120 or 180 days). At the preliminary stage of ABL the following risks are identified and assessed: risk of overdue payments, risk of non-compliance with anti-money laundering laws, tax risks, risks of prosecution for disclosure of personal data, risks of return of damaged or substandard goods, risks of non-compliance with warranty terms by manufacturers and suppliers of goods. Subsequently, ABL is provided by entering into a corporate agreement between a financial institution (often with state participation) and a company (which buys goods from SMEs), where the rights and obligations of each party in the organization and management of the SPV and the dispute resolution procedure are prescribed in detail.

Conclusion

The study showed that the market of lending to manufacturing enterprises in Russia has good growth potential, financial institutions should more intensively implement ABL, which in the future will help to increase the volume and reduce the turnover time of goods from SMEs, and therefore create objective market conditions to increase their marginal profitability and to reduce their overdue debts.

SMEs play a significant socio-economic role and that is why Russian Government supports them on a state level by creating corresponding structures. The authors conclude that federal and regional authorities, as well as local governments can promote the development of ABL financing by conducting explanatory work among SMEs through a network of state budget institutions «Entrepreneurship Development and Support Center» established in each subject of the Russian Federation, and municipal entrepreneurship development centers.

The authors hope that the results of the study will be useful in further ABL research, and that legal regulation and national practice in Russia will arouse the interest of other governments.

Funding: This research received no external funding.

Conflicts of Interest: The author declares no conflict of interest.

References

1. Abbasi, K., Alam, A., Brohi, N.A., Brohi, I.A., Nasim, S. (2021). P2P lending Fintechs and SMEs’ access to finance, Economics Letters 204: 109890, https://doi.org/10.1016/j.econlet.2021.109890

2. Alan, Y., Gaur, V. (2018). Operational Investment and Capital Structure Under Asset-Based Lending, Manufacturing & Service Operations Management 20(4): 637-654, https://doi.org/10.1287/msom.2017.0670

3. Aysan, A.F., Disli, M. (2019). Small business lending and credit risk: Granger causality evidence, Economic Modelling 83: 245-255, https://doi.org/10.1016/j.econmod.2019.02.014

4. Bari, F., Malik, K., Meki, M., Quinn, S.R. (2021). Asset-based microfinance for microenterprises: Evidence from Pakistan, SSRN Electronic Journal, http://dx.doi.org/10.2139/ssrn.3778754

5. Bijkerk, S., De Vries, C. (2019). Asset-Based Lending, Tinbergen Institute Discussion Paper, 032/VII, Tinbergen Institute.

6. Bikeeva, M.V., Inshakov, V.A., Fadeeva, I.M. (2020). Administrative barriers to the development of small and medium-sized businesses in the Republic of Mordovia: materials of practical research, Statistics and Economics 17 (6): 22-30, https://doi.org/10.21686/2500-3925-2020-6-22-30

7. Burov, P.D. (2020). Development of the process of lending to small and medium-sized businesses in the Russian Federation. PhD thesis (Moscow, 172 p.)

8. Central Bank of the Russian Federation. (2021). ECOSYSTEMS: REGULATORY APPROACHES. Consultative report (Moscow, 46 p.)

9. Cotrino A., Sebastián M., González-Gaya C. (2020). Industry 4.0 Roadmap: Implementation for Small and Medium-Sized Enterprises, Applied Sciences 10(23): 8566, https://doi.org/10.3390/app10238566

10. Eggers, F. (2020). Masters of disasters? Challenges and opportunities for SMEs in times of crisis, J. Bus. Res. 116: 199-208, https://doi.org/10.1016/j.jbusres.2020.05.025

11. Fonseca, D.F.P. (2015). The trust as special vehicle purpose corporation in Project Finance, Revista de la Facultad de Derecho y Ciencias Políticas 45(123): 547-575.

12. Kaldybayev, A. (2021). The principle of freedom of contract and corporate contract, Bulletin of Institute of legislation and legal information of the Republic of Kazakhstan 1(64): 142-151.

13. Korobeinikova, T. (2021). Legal essence of the corporate contract, Conference: VIII International Scientific and Practical Conference 'Current problems of social and labour relations' (ISPC-CPSLR 2020) 527: 385-389, https://doi.org/10.2991/assehr.k.210322.144

14. Kulikov, N.I., Kulikova, M.A., Shustova, V.N. (2021). The necessary state financial support to the Russian economy and citizens during the coronavirus pandemic, using online services, Finance and Credit 27 (4): 785-806.

15. Mazengera, H. (2017). Revenue-based lending for SMEs, International Journal of Financial Engineering 04(7): 1750035, https://doi.org/10.1142/S2424786317500359

16. Mittal, S., Khan, M.A., Romero, D., Wuest, T. (2018). A critical review of smart manufacturing & Industry 4.0 maturity models: Implications for small and medium-sized enterprises (SMEs), Journal of Manufacturing Systems 49: 194-214, https://doi.org/10.1016/j.jmsy.2018.10.005

17. Mkhaiber, A., Werner, R.A. (2021). The relationship between bank size and the propensity to lend to small firms: New empirical evidence from a large sample, Journal of International Money and Finance 110: 102281, https://doi.org/10.1016/j.jimonfin.2020.102281

18. Onyiriuba, L. (2016). Asset-Based Transactions, Lending and Credit Risk Control, In book: Emerging Market Bank Lending and Credit Risk Control (pp.219-232), https://doi.org/10.1016/B978-0-12-803438-5.00011-8

19. Piette Ch., Zachary M.-D. (2015). Sensitivity to the crisis of SME financing in Belgium, Economic Review 3: 31-45.

20. Razumovskaia, E., Yuzvovich, L., Kniazeva, E., Klimenko, M., Shelyakin, V. (2020). The effectiveness of Russian government policy to support SMEs in the COVID-19 pandemic, J. Open Innov. Technol. Mark. Complex. 6: 160, https://doi.org/10.3390/joitmc6040160

21. Ruohonen, J., Salminen, L., Vahtera, V. (2021). Governance and Steering of MOCs in Finland, Legal Perspective 19(3): 705-728, https://doi.org/10.4335/19.3.705-728(2021)

22. Sabitova, N.M., Khayrullova, A.I. (2015). The Guarantee Mechanism of Small Business Lending, Mediterranean Journal of Social Sciences 6(1): 164-168, https://doi.org/10.5901/mjss.2015.v6n1s3p164

23. Soininen, J., Puumalainen, K., Sjögrén, H., Syrjä, P. (2012). The impact of global economic crisis on SMEs: Does entrepreneurial orientation matter?, Management Research Review 35(10): 927–944, https://doi.org/10.1108/01409171211272660

24. Tagoe, N.A. (2016). Why lenders in the credit market of Ghana prefer Asset Based Lending (ABL), Business & Financial Times 2088 (Wed February 24-Thur 25, 2016): 26. ISSN 0855-1812.

25. Ushanov, A.E. (2020). On the issue of availability of credit resources for small and medium-sized businesses, Modern Science: actual problems of theory and practice, a series of «Economics and law» 4: 115-121.

26. Wen, J. (2021). Development of small Business in Indonesia, https://doi.org/10.31219/osf.io/tpdy7

27. Wilcox, J.A., Yasuda, Y. (2019). Government guarantees of loans to small businesses: Effects on banks’ risk-taking and non-guaranteed lending, Journal of Financial Intermediation 37: 45-57, https://doi.org/10.1016/j.jfi.2018.05.003

28. Włodarczyk, B., Szturo, M., Ionescu, G.H., Firoiu, D., Pirvu, R., Badircea, R. (2018). The impact of credit availability on small and medium companies, Entrepreneurship and Sustainability Issues 5(3): 565-580, https://doi.org/10.9770/jesi.2018.5.3(12

Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

A REVIEW of an article on the topic "Risk management in lending based on assets of small and medium-sized enterprises" (the article is presented in English). The subject of the study. The article proposed for review is devoted to topical issues of risk management in lending based on assets of small and medium-sized enterprises. Based on statistical data, opinions of scientists, and provisions of legal acts, the author draws conclusions about improving the risk management mechanism for lending in this area. The subject of the study was, first of all, empirical data and the provisions of science. Research methodology. The purpose of the study is not stated directly in the article. At the same time, it can be clearly understood from the title and content of the work. The purpose can be designated as the consideration and resolution of certain problematic aspects of the issue of risk management in lending based on assets of small and medium-sized enterprises. Based on the set goals and objectives, the author has chosen the methodological basis of the study. In particular, the author uses a set of general scientific methods of cognition: analysis, synthesis, analogy, deduction, induction, and others. In particular, the methods of analysis and synthesis made it possible to generalize and separate the conclusions of various scientific approaches to the proposed topic, as well as to draw specific conclusions from empirical data. Special legal methods played a certain role. In particular, the author actively applied the formal legal method, which made it possible to analyze and interpret the norms of current legislation (first of all, the provisions governing relations regarding lending in Russia). For example, the following conclusion of the author: "The category of the enterprise changes if during three years the income and number of employees have not reached the limits stated in part 4 article 4 of the Federal Law from 07/24/2007 No. 209-FL "About development of small and medium business in the Russian Federation". Organizations that failed to submit to the Federal Tax Service of Russia information on the number of employees or tax returns for the previous year are excluded from the register». The possibilities of the empirical research method should be positively assessed. In the context of the stated topic, the author of the article summarizes the available statistical and other data, draws important conclusions based on them. Thus, the following is noted: «The data provided are updated by the tax service annually on August 10. The information is posted on the 10th day of each month if the specified conditions are met by the companies and is publicly available for 5 years. Such types of information as newly established or terminated legal entities, updating names, addresses and licenses, manufactured products and participation in procurement - are updated every 10th day of every month. So, as of July 10, 2021 in Russia 5 622 914 SMEs produce 8489 types of products and services. SMEs employ 14,623,221 people». Thus, the methodology chosen by the author is fully adequate to the purpose of the study, allows you to study all aspects of the topic in its entirety. Relevance. The relevance of the stated issues is beyond doubt. There are both theoretical and practical aspects of the significance of the proposed topic. From the point of view of theory, the topic of risk management in lending based on assets of small and medium-sized enterprises is important, since it affects the social and economic aspects of the development of society. The author is right to reveal in detail the aspects of the relevance of the topic: "The importance of the small and medium-sized enterprises (SMEs) sector is recognized worldwide. SMEs, in aggregate, are the biggest employer in most countries, accounting for about two thirds of all employment in the UK, and an even greater proportion in Germany and Japan (Mkhaiber and Werner, 2021). A number of studies confirm the positive relationship between the relative size of the SME sector, the well-being of the population, and economic growth (Bijkerk and De Vries, 2019). In addition, the growth in the number of SMEs leads to increased competition in the economy. Companies with low-productivity are leaving the market, while companies with high-productivity are growing, leading to an increase in the overall productivity of the economy and an increase in the income of the population. Competition also leads to an increase in the quality of goods and services. The important role of the state, in particular banks and non-bank financial institutions with state participation, in asset-based SME financing (ABL financing) is certainly to create relevant trends for the entire financial services market in Russia in the next 3-5 years». Thus, scientific research in the proposed field should only be welcomed. Scientific novelty. The scientific novelty of the proposed article is beyond doubt. First, it is expressed in the author's specific conclusions. Among them, for example, is the following conclusion: "The study showed that the market of lending to manufacturing enterprises in Russia has good growth potential, financial institutions should more intensively implement ABL, which in the future will help to increase the volume and reduce the turnover time of goods from SMEs, and therefore create an objective market conditions to increase their marginal profitability and to reduce their overdue debts. SMEs play a significant socio-economic role and that is why Russian Government supports them on a state level by creating corresponding structures. The authors conclude that federal and regional authorities, as well as local governments can promote the development of ABL financing by conducting explanatory work among SMEs through a network of state budget institutions «Entrepreneurship Development and Support Center» established in each subject of the Russian Federation, and municipal entrepreneurship development centers». These and other theoretical conclusions can be used in further scientific research. Secondly, the author has proposed original generalizations of empirical data, which may also be useful to readers and specialists. Thus, the materials of the article may be of particular interest to the scientific community in terms of contributing to the development of science. Style, structure, content. The subject of the article corresponds to the specialization of the journal "Finance and Management", as it is devoted to the problems of risk management in the field of lending. The content of the article fully corresponds to the title, since the author considered the stated problems and achieved the research goal. The quality of the presentation of the study and its results should be recognized as fully positive. The subject, objectives, methodology and main results of the study follow directly from the text of the article. The design of the work generally meets the requirements for this kind of work. No significant violations of these requirements were found. Bibliography. The quality of the literature used should be highly appreciated. The author actively uses the literature presented by authors from Russia and abroad (Abbasi, K., Alam, A., Brohi, N.A., Brohi, I.A., Nasim, S., Bari, F., Malik, K., Meki, M., Quinn, S.R. and others). Most of the cited works have been published in the last few years, which underlines the relevance of the research. I would like to note the author's use of a large amount of empirical and other statistical data, which made it possible to give the study a law enforcement orientation. Thus, the works of the above authors correspond to the research topic, have a sign of sufficiency, and contribute to the disclosure of various aspects of the topic. Appeal to opponents. The author conducted a serious analysis of the current state of the problem under study. All quotes from scientists are accompanied by author's comments. That is, the author shows different points of view on the problem and tries to argue for a more correct one in his opinion. Conclusions, the interest of the readership.

The conclusions are fully logical, as they are obtained using a generally accepted methodology. The article may be of interest to the readership in terms of the systematic positions of the author in relation to the issues of risk management in the field of crediting. Based on the above, summing up all the positive and negative sides of the article, "I recommend publishing"

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.