|

DOI: 10.7256/2454-065X.2022.5.38403

EDN: GBGMPG

Received:

07-07-2022

Published:

06-11-2022

Abstract:

The article is devoted to assessing the role and determining the directions of improving the efficiency of the tax administration system in order to develop the activities of small and medium-sized businesses and the development of individual entrepreneurial initiative in the Russian Federation as priorities of the national economy. The study includes two parts: the first is devoted to the identification of modern trends in the tax administration of small businesses, the second - the directions of their development. The research methodology includes general scientific and private scientific methods of cognition, including analysis and synthesis, induction and deduction, method of comparison, generalization, analysis of dynamic series, graphical method of data representation and visualization. The scientific novelty of the study consists in the comprehensive development of proposals to improve a number of mechanisms and tools for tax administration of small businesses, ensuring the effective implementation of state policy in the field of small and medium-sized business development, contributing to the activation of individual entrepreneurial initiative. The scope of application of the research' results: The Government of the Russian Federation, the Ministry of Finance of the Russian Federation and the Federal Tax Service, the Ministry of Economic Development of the Russian Federation, other interested public authorities and management bodies can use the results of the study in determining ways to develop tax administration in the Russian Federation in terms of stimulating the activities of small and medium-sized businesses.

Keywords:

tax administration, tax control, small business, special tax regimes, taxation of the self-employed, busyness, shadow market, tax culture, automation, tax authorities

This article is automatically translated.

Numerous studies confirm the existing relationship between the relative size of the small and medium-sized enterprises (SMEs) sector and the economic growth of the country. The contribution of the SME sector to GDP in most developed countries ranges from 50% to 60% (in the EU, on average, 57.8%). In Russia, SMEs provide only 21% of GDP. The need for further stimulation of SME activity is also evidenced by statistical data (Table 1). Table 1 – Indicators characterizing the development and economic contribution of SMEs | Indicators | 2018 | 2019 | 2020 | 2021 | | Number of small enterprises, thousand units. | 2 701 | 2 518 | 2 363 | 2 301 | | The number of employees of small enterprises, thousand people. | 13 472 | 12 890 | 12 925 | 12 121 | | Revenue of small enterprises in domestic trade, billion rubles. | 48 459 | 53 314 | 48 948 | - | | Number of registered sole proprietors, thousand units. | 3 342 | 3 407 | 3 340 | 3 538 | | The number of employees of sole proprietors, thousand people. | 2 445 | 2 467 | 2 585 | 2 518 | | Revenue of sole proprietors in domestic trade, billion rubles. | 14 103 | 15 004 | 20 235 | - | | Total taxes of small businesses (except the ECN and PSA), million rubles. | 499 117 | 572 973 | 570 763 | 787 731 | | The share of small business taxes in the total amount of tax revenues, % | 2,34 | 2,55 | 2,75 | 2,80 | | Contribution of SMEs to Russia's GDP, % | 20,2 | 20,8 | 19,8 | 21 | Source: compiled by the authors according to Rosstat, the Federal Tax Service of Russia. As indicated in the Strategy for the Development of Small and Medium-sized Enterprises in the Russian Federation 2030, the SME sector is concentrated mainly in the field of trade, services; it accounts for only 5-6% of the cost of fixed assets and 6-7% of the volume of investments in fixed assets. As a result, the share of taxes on total income in the country's GDP is low – 0.4%. The totality of the above circumstances determine the need for further development of the system of state support tools for SMEs. At the same time, it is important to note that tax mechanisms occupy one of the leading places in this system. Traditionally, tax support is considered from the perspective of the application of tax benefits and special tax regimes by economic entities. However, in modern society, issues of fair competition and the creation of equal conditions for doing business in the market play an equally important role. Domestic and foreign tax administration practice shows that newly created firms are often small enterprises and are considered a high-risk group in terms of compliance with tax legislation, not only because of the risk of business failure, but also because of the large opportunities for tax evasion and a lower level of tax morality [1]. In Russia, this problem, as noted in a number of domestic studies, in particular M.V. Pyanova [2], L.M. Osadchuk [3], is complicated by the fact that in reality only microenterprises fall under tax support. Kurmanova L.R., Galimova G.A. associate effective tax administration of SMEs with simplification of its procedures, reduction of tax burden and application of special tax regimes [4]. A similar opinion is shared by Artemenko D.A., Vasilenko L.A. [5]. However, in our opinion, the development of tax administration tools should take into account other aspects, for example, to ensure economic equality of market participants, to create conditions for such equality. As the data of some sociological surveys show, entrepreneurs often do not fully legalize their activities because in this case they cannot compete with those entities that work outside the legal framework. Thus, the formation of an effective tax administration system is one of the fundamental factors for the development of SMEs and the stimulation of entrepreneurial initiative. We will analyze the main trends in tax administration that contribute to the growth of entrepreneurship in Russia and develop mechanisms for their improvement. Trends in SME tax administrationThe first trend is the simplification of procedures for registration and registration of business operations of SMEs (hereinafter MSPs). In this context, the most striking example of such interaction is the professional income tax, the main feature of which is probably the simplest system of administration of the Tax Service at the moment. At the moment, it is the only tax in the Russian tax system, information about which is accumulated through a special mobile application "My Tax" [6]. "My Tax" is the official application of the Federal Tax Service of Russia for taxpayers of professional income tax. It has several important advantages that greatly simplify the accounting and administration of the NPA.

Firstly, the application replaces the cash register and reporting. However, if the self-employed person acts through an intermediary, the customer needs other documents confirming the fact of the transaction between the self-employed and the customer, for example, an agency agreement, acts of work performed (services rendered) [7] to confirm the expenses. This creates a minimal administrative burden on payers, on the one hand, and greatly simplifies tax control, on the other. In particular, documents and information sent by the tax authority to an individual applying the NAP through the mobile application "My Tax" on paper are not sent by mail. Registration of the payer and its removal from the register is carried out through "My Tax" without actual presence in the tax inspectorate. The provision of a tax return is also not provided. Moreover, the application allows for mutual exchange of information, for example, the amount of tax calculated by the tax authority for payment comes to the payer's personal account by electronic notification no later than the 12th day of the month following the expired tax period. Secondly, "My Tax" can act as an electronic platform for fulfilling the obligations of the payer (payment of tax): by the decision of the taxpayer – in an acceptance or non-acceptance order. The tax is paid no later than the 25th day of the month following the expired tax period at the place where the taxpayer conducts its activities. It is important to note that the NAP administration system has a positive effect for the legalization of self-employment (according to 2021, the official number of registered NAP payers amounted to 3862 thousand people who paid 21.3 billion rubles to the budget since the beginning of the experiment), together with its influence with an unprecedented low fiscal burden (rate of 4 or 6%). Another manifestation of this trend is the introduction from July 1, 2022 in the experimental mode of the automated simplified taxation system (AUSN). It is important to note that the AUSN is the next direction of regulation for microbusiness, since only organizations and sole proprietors with a number of employees not exceeding 5 people, incomes not exceeding 60 million rubles and a residual value of not more than 150 million rubles will be able to apply it, since calculations with its application can only be carried out in a non-cash format through specially accredited FTS banks. If the income is not received for non-cash settlement (for example, by netting), the information must be submitted to the tax authority through the taxpayer's personal account. At the same time, tax audits are canceled for the period of application of the AUSN. For the payers of the AUSN, the calculation of tax liabilities is carried out automatically: the bank will perform the duties of the personal income tax agent; the calculation of the obligations of the SME entity itself is carried out by the tax inspectorate on the basis of cash flow data on the account [8]. It is important to note that, as in the case with the application of "My Tax", the AUSN does not involve the submission of tax reports and is designed to significantly reduce the fiscal burden due to the application of the 0 tariff for mandatory insurance premiums (while increasing the base rate of a single tax). With all the advantages of such administration, a number of disadvantages can be identified, in particular, the AUSN assumes only a non-cash form of remuneration, which leads to the need to purchase a license for a client bank and additional administrative costs for business. Secondly, the AUSN assumes not quarterly, but monthly payment of tax. The second trend is the automation of tax administration procedures. In the context of the development of the digital economy in the Russian Federation, this area is one of the main activities of tax authorities. Automation helps to reduce the time for tax control procedures due to online interaction, reporting, registration and other procedures (starting from the assignment of TIN for individuals from the moment of birth due to the automatic transmission of information from the unified state register of civil status records, ending with the use of automated means of control ASC-VAT, AIS Tax, etc.). Electronic services of the Federal Tax Service of Russia are of particular importance in terms of automation of SME administration procedures. At the moment, more than 60 services have been developed. The bulk of modern electronic services of the Federal Tax Service of Russia is aimed at simplifying administration and accounting and can be applied by SMEs. At the same time, such services as "Tax calculators", "Electronic document management" and "Software tools" are of the greatest importance, which allow optimizing tax accounting and the tax burden of small and medium-sized businesses. The third trend is the simplification of accounting and reporting. First of all, we note that this direction intersects with the first one, using "My tax" and AUSN, payers do not submit tax reports. In addition, since 2020, the provision of calculations for the property tax of organizations on advance payments has been canceled; since 2021, legal entities (as well as individuals) do not submit tax returns on transport and land taxes, which are automatically calculated by the tax authority (for the tax period 2020). Prospective changes also indicate the continuation of this trend, in particular, from 2023 (for 2022), the submission of reports on the property tax of organizations, in respect of objects taxed at cadastral value, will be canceled. In the context of this direction, it is also necessary to highlight the possibility of paying a single tax payment introduced by Federal Law No. 379-FZ of 29.11.2021. From July 1, 2022, as part of the pilot project, until the end of the calendar year, organizations and sole proprietors will be provided for the payment of taxes, insurance premiums and trade fees by one payment order, as well as penalties, fines and interest on them. This approach can be applied by those payers who have verified the calculations with the tax inspectorate and submitted a corresponding application no later than April 30, 2022. These innovations together contribute to reducing the number of errors in the preparation of documentation, simplifying accounting, reducing the burden on the information systems of tax authorities. However, from the perspective of taxpayers, they also carry some risks that hinder the development of entrepreneurial initiative. For example, being on a single payment, if an SME has arrears that are at the stage of contestation, they will be written off first of all in a non-acceptance order. Moreover, by applying a single payment, the calculation of obligations will occur at least 5 days earlier, based on the established deadlines for the provision of a notification for the payment of tax. In the context of recent changes, the experimental approach that has spread to the practice of taxation and tax administration should be positively assessed, which allows preliminary assessment of the fiscal, social and economic effects of tax innovations to the stage of their widespread and compulsory implementation.

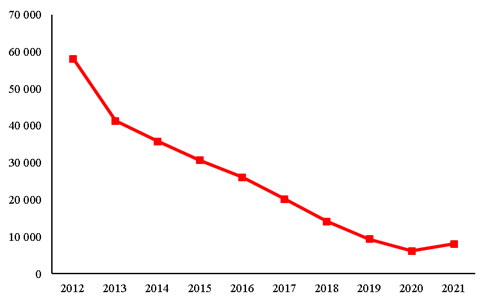

The fourth trend is the transition to automated accounting of SME income. It is also one of the more detailed directions of the development of the third trend. Legalization of SMSP income has been a priority activity of the Federal Tax Service of Russia for more than a dozen years. At the same time, significant changes in this area have been achieved relatively recently. One of the manifestations of this trend is the growing number of professional income tax payers (it was noted earlier). Another, the most striking, manifestation is the use of cash register equipment, access to information to which is provided to the tax authority. According to Article 2, paragraph 2.1 of Federal Law No. 54-FZ of 22.05.2003 "On the use of Cash register equipment" (CCT), all entrepreneurs are required to use online cash registers for non-cash and cash payments with individuals, to issue a printed cash receipt or an electronic receipt to the buyer (in SMS, to e-mail mail, etc.) [9]. In accordance with paragraph 3 of Article 2 of Federal Law No. 54-FZ of May 22, 2003, some organizations and sole proprietors can make settlements without the use of CCT (for example, when trading in newspaper and magazine kiosks, at markets, fairs, exhibitions, from tanks, etc.). This makes it possible to free some microbusiness entities from additional costs for the purchase of KKT while simultaneously applying strict reporting forms that replace KKT. Article 5 of this Federal Law provides for a number of obligations of organizations and individual entrepreneurs using cash register equipment. Organizations, with the exception of credit, and individual entrepreneurs using cash registers, are obliged to: - register cash register equipment with tax authorities; - use serviceable cash register equipment for cash payments and (or) settlements using payment cards; - issue cash receipts printed by cash register equipment to customers (clients) at the time of payment; - to ensure the maintenance and storage of documentation related to the acquisition and registration, commissioning and use of cash register equipment, as well as to provide officials of tax authorities with unhindered access to it; - during the initial registration and re-registration of cash register equipment, the introduction of information into the fiscal memory of the KKT and the replacement of fiscal memory drives with the participation of representatives of tax authorities [10]. The open resource of the Federal Tax Service of Russia "Cash Register equipment" contains methodological recommendations for its use, allows you to check the presence of the device in the register of KKT by any user with a registration number. As of 01.01.2022, more than 3.7 million CCT units were registered; checks were carried out on the correctness of the application of CCT by tax authorities in the amount of 103 thousand units, including penalties for 498 million rubles. The fifth trend is a reduction in the number of SMSP tax audits. This trend has two manifestations: short-term, associated with pandemic restrictions and sanctions pressure (for example, a moratorium on certain inspections of small and medium-sized businesses until the end of 2022) [11]; long-term, caused by the introduction of risk-based tax control (Figure 1).

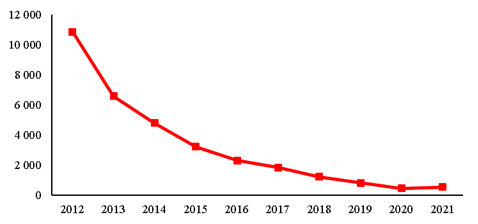

Source: compiled by the authors on the basis of data from the Federal Tax Service of Russia. Figure 1. On-site inspections of organizations, sole proprietors, persons engaged in private practice and individuals, units.During the period from 2012 to 2021, the number of on-site inspections decreased by almost 7.2 times. At the same time, the number of on-site inspections of individual entrepreneurs and other persons engaged in private practice has decreased by almost 20.9 times (Figure 2).

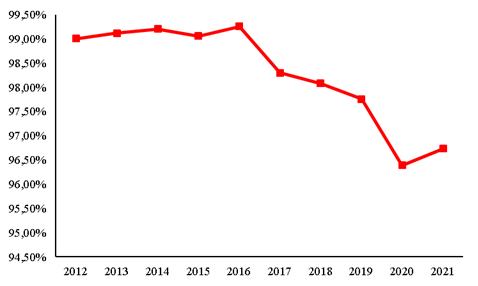

Source: compiled by the authors on the basis of data from the Federal Tax Service of Russia. Figure 2. On-site inspections of sole proprietors and other persons engaged in private practice, units.The practice of recent years has shown that an on-site tax audit against an SME is appointed only in cases of almost complete confidence of inspectors in the presence of a tax offense (Figure 3).

Source: compiled by the authors on the basis of data from the Federal Tax Service of Russia. Figure 3. The proportion of on-site inspections in which violations of sole proprietors and other private practitioners were detected, % The share of on-site inspections in which violations of sole proprietors and other private practitioners were detected consistently exceeds 95% during the analyzed period. It is important to note that the main reason for the application of on-site tax control to SMEs is the problem of business fragmentation, which can be successfully solved by expanding the revenue criterion for the purposes of applying the STS (the main source of business fragmentation) [10]. Thus, the reduction of administrative pressure on SMEs is the most important factor in stimulating the development of entrepreneurial initiative along with a low tax burden. Development of SME tax administrationPromising directions for the development of tax administration of the Federal Tax Service of Russia are largely based on digitalization and automation of control and accounting procedures. We believe that these vectors of activity of tax authorities are promising and generally contribute to the development of entrepreneurial initiative. At the same time, as it was noted earlier, the issues of legalizing the activities of MSPs, increasing their tax literacy and awareness, which involve the development of other areas of their tax administration, remain unresolved to the end. 1. Third party reporting It has been repeatedly noted in the literature that in Russia there is a low level of tax culture and compliance with tax legislation, referred to in foreign practice as the "level of voluntary compliance" [13]. For example, there is an extremely low degree of declaration of income from the rental of residential premises. By the end of 2020, about 5.7 million families (10% of the total number of households) in the Russian Federation rent housing on the market, but tax revenues from such business are minimal [14]. In turn, there are practically no shadow operations in the water supply and waste disposal sector [15]. It is important to note that the gap in the level of voluntary tax compliance between different types of income and industries is not limited to Russia. Similar compliance gaps have been found in other advanced economies [16], in developing countries [17] and in laboratory experiments [18].

What causes such a significant gap in the level of voluntary compliance between different industries and types of income? The scientific literature attributes most of this gap to the presence (or absence) of third-party income reporting [19]. Third-party reporting requires sources such as employers and banks to report taxable income received by individuals directly to the government (or other authorized body), which allows the government to verify tax returns from these sources [20]. Income that is not subject to third-party reporting is less likely to be detected by the tax authorities. An example of such reporting is Form 1099 - K (Transactions on Payment Cards and Third-party Networks), filled out by US banks for the IRS and taxpayers. Form 1099-K contains the following information: gross transaction value, transaction value for each month of the tax year, gross number of payment transactions, and any federal or state income tax withheld. Any payments received through settlement organizations are reflected in Form 1099 - K, however, payments made through third-party settlement organizations are included in the report only if the annual gross amount of transactions of an economic entity exceeds $ 20,000, and the total number of transactions exceeds 200. In this context, the expansion of the powers of tax authorities in Russia in terms of calculating personal income tax on a number of transactions (for example, receiving interest income from a bank), as well as tax agents (in terms of securities transactions) should be assessed as promising areas of tax administration. To further legalize the activities of SMEs, the use of third-party reporting seems to be a promising direction of reform. In this context, the use of third-party reporting has the following advantages as a tool for developing administration and stimulating the legalization of SME income: First, third-party reporting is generally regarded as the gold standard in the context of advanced economies. It makes it possible to increase the level of self-declaration of individual tax bases by SMEs, due to the fact that it creates artificial "pressure" on them due to the possibility of disclosure of commercial information by third parties and increasing the likelihood of tax risks; secondly, the potential for the use of third-party reporting lies in the possibility of detailing commercial relationships, on the basis of which tax evasion schemes not disclosed by the Federal Tax Service of Russia can be identified; thirdly, despite the fact that third-party reporting is traditionally considered as a tool for the administration of individuals, it can also be applied to small and microbusiness. Positive effects (in terms of compliance with legislation and tax collection) of the use of third-party reporting in small businesses are noted in the VAT systems of Chile and Brazil, in corporate taxes in Ecuador, in insurance payments in Mexico. At the same time, there are two possible options for establishing third-party reporting for SMEs (Table 2). Table 2 – Options for establishing third-party reporting | Criteria | Direct reporting scheme | Hybrid reporting scheme | | Point | the third party and/or the person filing the tax return provide the information directly to the tax authority | only taxpayers themselves report their information to the tax authority, and also attach documentation issued by a third party | | Interaction with third-party tax authorities | Direct | Indirect (only through the taxpayer) | | Additional expenses | Creation of data infrastructure (large investments) | Low cost of implementation | | Performance | It is most effective in countries with a low level of shadow economy, high income and high institutional quality | It is most effective in countries with a high level of shadow economy, low income and low institutional quality | Source: compiled by the authors. It is important to note that the choice of a priority scheme for reporting third parties depends on the level of development and administrative capacity of the country. Given the high level of digitalization of Russian tax administration in certain areas, we propose to use a combined approach, using both reporting options. For example, direct reporting on transaction volumes and sales can be introduced for marketplaces in relation to economic entities trading through them, provided that business processes are fully automated. At the same time, an important aspect in the context of the application of third-party reporting is the presence of a threshold criterion for the provision of such reporting. Setting the threshold value affects the administrative burden on the tax authorities, as it determines the amount of documentation that needs to be confirmed. 2. Taxpayer training. One of the potential measures that has been studied for quite a long time in theory and in practice is the use of training programs for entrepreneurs. Unfortunately, so far, recent experimental evaluations of the effectiveness of such programs, both in developing and developed countries, have demonstrated (at best) a modest impact on business skills and productivity. However, most of these trainings were neither individual nor partially personalized, were voluntary in nature and were often focused on acquiring business skills and writing business plans. In this light, the Dutch tax authorities have developed a unique training program [21]. The objectives of this program are as follows: to help aspiring entrepreneurs structure their cash flows, inform them about relevant regulations and inform them about expenses, future financial responsibilities and tax obligations. The training is free, compulsory, personal and conducted by the tax authorities. At the same time, the costs of the program are fully paid by the tax authorities and consist of 6-8 hours spent on preparing and conducting the training. During the experiment, it was planned to achieve the following twofold result. Firstly, awareness of tax regulation and future tax obligations should have led to more conscientious tax behavior of the entrepreneur in terms of timely filing and payment of tax returns, fewer intentional and unintentional errors in their tax returns, as well as compliance with the requirements of legal administration. Secondly, it was expected that the first entrepreneurs would improve their business results within the framework of training.

As a result of the implementation, the following was revealed. The first key conclusion of the Dutch experiment is the modest but positive effect of training on tax behavior, especially on compliance with legal requirements for conducting business administration [21]. The second conclusion: training does not affect the survival of the business, however, trained entrepreneurs have significantly higher profits compared to the control group due to lower business costs. It seems possible to apply such an approach in domestic practice. In particular, it involves the implementation of the following actions: 1) creation of a training center on the basis of the Federal Tax Service of Russia and other responsible executive bodies of the Russian Federation (most optimally – in an online format, with the right to register and access through taxpayers' personal accounts); 2) formation of basic free business courses for aspiring entrepreneurs with video lectures and additional paid courses in small groups (on specific economic issues in the form). ConclusionAs the results of this study have shown, the development of tax administration tools is not only a source of additional tax revenues, but also an important factor in stimulating the activities of small and medium-sized businesses, as well as entrepreneurial initiatives. At the present stage of development, the Federal Tax Service of Russia has achieved significant positive results in the context of the evolution of tax control and administration tools, however, reserves in this direction are very large. In particular, the directions proposed by the authors for the application of third-party reporting and taxpayer training can become an effective complement to the modern tax system, provided they are qualitatively adapted to Russian realities and take into account the experience already accumulated. They are aimed at creating equal competitive conditions in the market for SMEs, which distinguishes the study from those previously presented on the subject under consideration.

References

1. Torgler B. Tax Compliance and Tax Morale: A Theoretical and Empirical Analysis // Edward Elgar Publishing (2007)

2. Pyanova M.V. On some features of the application of tax on professional income // Taxes and taxation. 2021. No.

3. S. 86-103. 3. Osadchuk L.M. Improving the practice of applying special tax regimes for various categories of taxpayers // Economics and Entrepreneurship. 2020. No. 8 (121). S. 1284-1287.

4. Kurmanova L.R., Galimova G.A. Issues of tax administration of the activities of small businesses // Innovative development of the economy. 2021. No. 1 (61). pp. 181-189.

5. Artemenko D.A., Vasilenko L.A. Key problems of tax administration of small and medium-sized businesses in the Russian Federation // Theoretical Economics. 2020. No. 6 (66). pp. 96-100.

6. Tikhonova A.V. Key issues of taxation of the self-employed in the CIS countries // Financial magazine. 2021. V. 13. No. 6. S. 81-97.

7. Letter of the Federal Tax Service of Russia dated October 30, 2020 N AB-4-20/17902@

8. Zonova A.V., Goryachikh S.P., Pechenkin K.A. Taxation of individual entrepreneurs, taking into account tax innovations in 2022 // Natural Humanitarian Research. 2022. No. 39 (1). pp. 391-396.

9. Goncharenko L.I., Advocatova A.S., Alekseevich B.A. Identification of the obligation to fix settlements in the system of tax legal relations // Economics. Taxes. Right. 2022. V. 15. No. 2. S. 156-166.

10. https://www.nalog.gov.ru/rn77/related_activities/statistics_and_analytics/effectiveness/#t31 (date of access: 05/09/2022).

11. Decree of the Government of the Russian Federation of September 8, 2021 N 1520 “On the specifics of carrying out planned control (supervisory) activities in 2022, scheduled inspections in relation to small businesses and on amending certain acts of the Government of the Russian Federation”

12. Khomushka D.A. Simplified system of taxation in the implementation by taxpayers of schemes for "splitting business" // Vestnik nauki. 2019. Vol. 2. No. 5 (14). pp. 286-292.

13. Bibek Adhikari, James Alm, Timothy F. Harris Small business tax compliance under third-party reporting // Journal of Public Economics. 2021. Volume 203. https://doi.org/10.1016/j.jpubeco.2021.104514

14. Draft Strategy for the development of the construction industry and housing and communal services of the Russian Federation until 2030 with a forecast for the period up to 2035 [electronic resource]: https://minstroyrf.gov.ru/upload/iblock/672/V-Strategiya-na-sayt-i-GASU.pdf (accessed on 01/08/2022).

15. Rosstat measured the “invisible” economy of Russia [electronic resource]: https://www.rbc.ru/economics/29/08/2019/5d651ed89a79474a0d725030 (date of access: 04/17/2022)

16. Jacobsen Henrik Kleven, How Can Scandinavians Tax So Much? // J. Econ. Perspect., 28 (4) (2014), pp. 77-98.

17. Naritomi Joana Consumers as Tax Auditors // Am. Eco. Rev., 109 (9) (2019), pp. 3031-3072.

18. Alm James, Deskins John, McKee Michael Do Individuals Comply on Income Not Reported by Their Employer? // Public Finance. Rev., 37 (2) (2009), pp. 120-141.

19. Almunia Miguel, Lopez-Rodriguez David Under the Radar: The Effects of Monitoring Firms on Tax Compliance // Am. Eco. J. Econ. Policy, 10 (1) (2018), pp. 1-38.

20. Carrillo Paul, Pomeranz Dina, Singhal Monica Dodging the Taxman: Firm Misreporting and Limits to Tax Enforcement // Am. Eco. J. Appl. Econ., 9 (2) (2017), pp. 144-164.

21. Nagel Hanskje, Rosendahl Huber Laura, Van Praag Mirjam, Goslinga Sjoerd The effect of a tax training program on tax compliance and business outcomes of starting entrepreneurs: Evidence from a field experiment // Journal of Business Venturing. 2019. Volume 34. Issue 2. Pages 261-283. https://doi.org/10.1016/j.jbusvent.2018.10.00

First Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the study. The article is devoted to modern trends in the development of tax administration of small and medium-sized businesses. First of all, it is necessary to note the inaccuracies in the title of the article: firstly, the word "development" is duplicated twice, and secondly, what is the difference between development trends and development directions? In general, the content of the article corresponds to the key content of the stated research topic. Research methodology. The study is based primarily on the analysis of data from the Federal Tax Service on the number of on-site inspections of organizations and individual entrepreneurs. The results are presented graphically in the form of several figures that allow you to track the dynamic change of a number of indicators. The relevance of the study of the problems of tax administration of small and medium-sized businesses is high due to their importance both for the state (the Federal Tax Service, the Ministry of Finance of the Russian Federation and other public authorities of the Russian Federation) and for economic entities whose activities are targeted by established procedures within the framework of tax administration. The scientific novelty in the reviewed article is partially present. However, it is recommended to strengthen the author's contribution and the level of justification when identifying existing problems and developing recommendations for their solution. Style, structure, content. The style of presentation is scientific. The structure of the work, in general, is built logically: substantiation of the relevance and formulation of the problem, identification of key trends in the development of tax administration of small and medium-sized businesses, identification of directions for improving the efficiency of the tax administration system of small and medium-sized businesses. Familiarization with the content of the work allows us to formulate the following recommendations to the author: 1) formulate and substantiate the scientific problem more clearly in the introductory part of the article, as well as identify the contribution of other researchers to its study; 2) when determining trends in the development of tax administration, identify the specific pros and cons of each of them, as well as possible consequences for both the tax system and specific small and medium-sized businesses; 3) taking into account the fact that the subtitle in the text sounds like "directions for improving the efficiency of the tax administration system ..." to ensure that the content corresponds to this message, the impact of the author's recommendations on improving the efficiency of the tax administration system should be assessed. The elimination of these comments will significantly improve the quality of scientific research and the level of scientific novelty. Bibliography. The author has studied the key publications of the periodical press in domestic and foreign publications on the issue under consideration. At the same time, you should carefully check the quality of their design in accordance with the requirements of GOST. Moreover, it also seems advisable to study Rosstat data characterizing the development of economic entities (including the selected target group), as well as data from the Federal Treasury, revealing the volume of revenue receipts to the budgets of the budgetary system of the Russian Federation. Appeal to opponents. The text of the article contains a partial reference to the results of research conducted by other authors. It is recommended to clearly indicate what the author's increment of scientific knowledge is compared to what was obtained by other researchers. Conclusions, the interest of the readership. If the content is adjusted according to the comments indicated in the review, the article will be of interest to a wide readership and may be recommended for publication.

Second Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The article submitted for review is devoted to the identification of modern trends in the development of tax administration of small and medium-sized enterprises. The research methodology is based on the generalization of scientific publications on the topic of the work, the use of general scientific research methods, and the analysis of statistical data. The authors rightly attribute the relevance of the work to the existence of a link between the relative size of the small and medium-sized business sector and the economic growth of the country, as well as the low proportion of small and medium-sized businesses in Russia in comparison with other countries. The scientific novelty of the reviewed study, according to the reviewer, consists in substantiating the areas of application of third-party reporting and taxpayer training as elements of improving the tax administration of small and medium-sized enterprises. The following sections are structurally highlighted in the article: Trends in SME tax administration, Development of SME tax administration, Conclusion, Bibliography. The article considers the following trends in the tax administration of small and medium-sized enterprises in the Russian Federation: simplification of registration procedures and registration of business operations of this category of taxpayers; automation of tax administration procedures; simplification of accounting and reporting; transition to automated income accounting. The authors believe that the issues of legalizing the activities of small and medium-sized enterprises, increasing tax literacy and awareness of entrepreneurs remain unresolved to the end; they focus on third-party reporting and the need for taxpayer training. In conclusion, the authors conclude that the development of tax administration tools is not only a source of additional tax revenues, but also an important factor in stimulating the activities of small and medium-sized enterprises, as well as entrepreneurial initiatives. The presentation of the material follows the scientific style adopted for journal articles. The bibliographic list includes 21 sources – publications of domestic and foreign scientists, normative legal acts and Internet resources on the topic of the article. The text contains targeted references to literary sources. A number of comments should be made. Firstly, an abbreviation is used in the title of the article, which should be avoided, since this abbreviation is ambiguous and can be perceived by different categories of readers not only as "small and medium-sized enterprises", but also as "intersectoral social partnership", "mineral resource potential" and in other semantic interpretations. In the feed of this, the abbreviation "NAP" is not at all accompanied by decoding – additional efforts have to be expended to recognize its essence in the context of the material being presented. Secondly, the initial part of the text is not highlighted in an independent introductory section with the appropriate title. The reviewed material corresponds to the direction of the journal "Taxes and Taxation", has been prepared on an urgent topic, has elements of scientific novelty and practical significance, may arouse interest among readers, and in general can be published.

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.