|

DOI: 10.7256/2454-0668.2022.3.38346

EDN: KWCYIS

Received:

28-06-2022

Published:

06-07-2022

Abstract:

The objective need for environmental investment to overcome the reproduction of anti-sustainable environmental trends in the modern Russian economy and its post-pandemic recovery is substantiated. Environmental investments that meet the criteria of the global ESG agenda are positioned as responsible in their essence and transformative in their functional role. Original scientific judgments are presented on the impact of such investments on the dynamics and intensity of "green" innovations (new technologies, production processes, supply chains capable of solving issues of waste processing and industrial reproduction of raw materials from waste resources, as well as the use of alternative energy sources, etc.), which are able to generate long-term and sustainable growth of aggregate factor productivity (TFP) and ensure the radical transformations of the economic system associated with the formation of a "green" circular economy. Regressive models (growth curves) have been constructed for the current domestic economy, taking into account the volume of environmental investment, confirming the hypothesis of the "weakness" of this process in the Russian Federation, including due to the lack of significant changes in the state environmental policy. The minimum necessary economic tools of the state policy in the field of stimulating environmental investment in Russia have been formed in order to post-pandemic recovery of its economy and ensure long-term sustainable growth of TFP. The conducted research makes a certain contribution to the development of the theory of endogenous economic growth by taking into account the impact of environmental investment, which is initially focused on the effective use of natural capital, on the maximum involvement of waste resources in economic turnover, the replacement of traditional production technologies with environmentally friendly or low-carbon, the improvement of ecosystems, the production potential of the economy, the quality of the environment and social changes.

Keywords:

rental model of the economy, anti-sustainable environmental trends, pandemic economic recession, environmental investment, deinvestments, green innovation, cumulative factor productivity, sustainable economic growth, circular economy, growth curves

This article is automatically translated.

The scale of the upheavals taking place in the global (including Russian) economy gives reason to consider the current economic situation as a kind of global cataclysm comparable to, or even surpassing, the parameters of the Great Economic Depression. Quarantine measures applied by most countries of the world, including Russia, have reduced the mortality rate from the COVID-19 pandemic, but have caused a serious economic recession, which is exacerbated by unprecedented external sanctions pressure on the Russian Federation. Against this background, all the problems and limitations of development that have accumulated in the global and domestic economy in recent decades are becoming more acute. Undoubtedly, among the main current trends and patterns, environmental ones occupy a priority place. I must say that the current crisis, for example, for Russia can be reflected by such indicators as a drop in demand for Russian exports, the vast majority (about 90%) of which is raw materials and semi-raw materials; a drop in production due to inflation and a decrease in investment activity. It is obvious that in such conditions, not only our country, but also all the economies of the world – poor, rich and medium-developed for the coming decades are programmed "to promote progressive, inclusive and sustainable economic growth." (UN SDG Goal 8). And this is quite understandable. Introduction The extremely difficult situation that developed after the global crisis of 2008-2009 in different countries of the world, including Russia, and was characterized by "chronically low economic efficiency everywhere" (Spence, 2021) combined with a progressive "social recession" even in developed economies (Jackson, 2017) and "planetary manifestations of environmental growth constraints" (Gubanov, 2014), today is complicated by the devastating consequences for economic activity and other aspects of society of the ongoing COVID-19 pandemic. Economic growth is, first of all, an opportunity to provide most people with a decent level of income and wealth (Jackson, 2009). In addition, it increases their chances of productive and creative employment, the ability to be valuable to society, education and health, in short, everything that creates freedom and the possibility of self–realization (Spence, 2012). In other words, "while the economy is growing, positive feedback mechanisms tend to push the system in the direction of further development" (Jackson, 2009). In this context, we note that in accordance with the UN Sustainable Development Goals (SDGs) for the period 2016-2030, which are a kind of call to action emanating from all countries of the world, the annual GDP growth per capita (the most adequate indicator of welfare growth today) is set for the least developed economies at 7% (Goal 8%); The Supreme Eurasian Economic Council has identified 5-5.5% for the EAEU member states as a target for this indicator. It is noteworthy that, according to the estimates of Academician of the Russian Academy of Sciences S. Yu. Glazyev, even in the conditions of external sanctions pressure on Russia, a "normal workable" model of the national economy, not export-oriented (rent-oriented), but tuned to constant technological modernization as a built-in, organic component, can provide annual economic growth of at least 10% (Glazyev, 2018). In addition, it must be recognized that the growth of the economy in its neoliberal model (in relation to modern Russia – export–raw materials), in which its main "locomotive" is gross consumption, leads to an increase in the burden on the environment under the influence of an increase in the ecological footprint and ecological debt of mankind, deterioration of environmental quality (oversaturation of the atmosphere with greenhouse gases and climate change, the build–up of harmful waste and emissions, the reduction of biodiversity and freshwater reserves, soil degradation, depletion of mineral resources, etc.). The identified environmental challenges, which in the coming XXI century have acquired a planetary character, dictate the need to change the economic paradigm: "the transition to an economy that does not function in spite of the productive forces of nature, and together with them" (Fuks, 2016), provided by radical transformations of the economy in accordance with the global ESG agenda (Bobylev, 2020; Sukharev, 2019). It is important to note that even in the conditions of a pandemic world, it was the ecological and economic priorities of the development of countries that were emphasized at the World Economic Forum held in Davos in 2020. Significance of the problem For Russia in the current conditions, when unprecedented external sanctions pressure actually coincided with the exhaustion of the possibilities of the export-raw materials (consumer, rental) model of economic growth established here, it is difficult not to recognize that the country's economy is arriving at a bifurcation point of its development, in a state of unstable equilibrium, when there are several main development options continuing this unstable trend. It must be said that the National projects adopted in accordance with the Decree of the President of the Russian Federation dated 07.05.2018 No. 204, new proposals for post-crisis economic recovery in the face of external sanctions pressure, are certainly necessary and capable of supporting the development of the domestic economy. At the same time, from a strategic perspective, they are insufficient to ensure GDP growth rates that are ahead of global dynamics. The current situation forces us to look for ways to form a new model of the national economy capable of developing and providing a high level of income not at the expense of natural and opportunistic rents, but at the expense of knowledge-intensive, high-tech and energy-efficient production. In this context, the actions taken should be adequate to the general laws and trends of the modern era, among which environmental ones undoubtedly occupy a priority place (Fishman, Martyanov, Davydov, 2019). In other words, we are talking about a model of the national economy that should be adequate to the principles of the global ESG agenda and have the following important features: · priority in development is given to high-tech and high-tech manufacturing and infrastructure types

economic activity with minimal impact on the environment; · environmentally efficient interactions of production and consumption, reducing environmental pollution; · waste-free and resource recycling; · ensuring environmental safety as a special social good, etc. So, Russia today faces a problem that can be called a "transition problem", when the generally accepted formulation of the question of ensuring economic growth on the basis of such a component of aggregate demand as "investment spending" becomes of fundamental importance (Sukharev, 2019, 2020; Spence, 2021). In the context outlined above, the main condition and a powerful factor "triggering the increasing dynamics of positive economic growth" (Spence, 2012) should be environmental investments, "which create the right environment for such a flourishing of innovations and such a transformation of the environment that we cannot even imagine" (Gordon and Mokyr, 2016). It is important to say that Russia can benefit from a shift in emphasis on environmental investment for a number of reasons: 1) ignoring its increasing role, due to the preservation of the export-raw materials model of the economy in our country, reproduces anti-sustainable environmental trends (high level of natural intensity of production and pollution intensity); depletion of natural capital; predominance of nature-exploiting and polluting economic activities in the structure of the economy; natural resource nature of exports, etc.), which, in turn, 2) a significant excess of the economic costs of environmental degradation in the Russian Federation (according to World Bank experts, they amount to 1-6% of GDP) compared to the value of this indicator for developed countries (Damianova, 2018), which reduces the competitiveness of the Russian economy in the world market; 3) such investments can create new jobs, provide meaningful work with a low carbon footprint, reduce poverty, improve the standard and quality of life of the population (Banerjee and Duflo, 2019); 4) in the current situation, Russia does not need to choose between economic growth and environmental protection; it can achieve these two goals at the same time, due to the existing bio-capacity reserve. The economic recession caused by the COVID-19 pandemic and unprecedented external sanctions pressure on Russia provide it with a unique opportunity to invest in radical transformations of the economy of the XXI century, provided by the implementation of the principles of the global ESG agenda, in order to make a decisive turn from the sidelines to the highway of socio-economic progress. Environmental investments are responsible investments in their essence, and transformative in their functional role. In the framework developed in modern economic science complex debate about the quality of the environment in economic growth, an increasing number of scientists and experts associate the possibility of a return to sustainable growth of "total factor productivity" (TFP)for the growth of income and wealth (Gordon, 2016), with the change in the balance between consumption and investment in the economy in favour of the latter (Jackson, 2009, 2017; Spence, 2012, 2021; Sukharev, 2019, 2020). So the Nobel Prize winner in Economics M. Spence argues that "growth requires investment – a sacrifice that is being made now for the sake of future benefits," and innovation generates it (growth) (Spence, 2021). In several papers as a possible "support" and a powerful driver of sustainable growth in TFP in extreme environmental constraints positioned "significant advance environmental investments" (Jackson, 2009, 2017; Banerjee and Duflo, 2019; Kormishkina, 2021; Spiridonova, 2020). For example, the Nobel Prize winner in Economics A. Banerjee and E. Duflo, clarifying the theory of creative destruction developed by J. Schumter, note that "... aggregate factor productivity also increases when we discover new ways to reduce waste or time losses associated with underutilization of raw materials or workers." I must say that environmental investments have not been studied enough to date and do not have a generally accepted clear terminological definition; they are often identified with "green financing". Based on the interpretation of the "green" economy of UNEP and numerous competing goals of environmental investment (reduction of carbon dioxide emissions into the atmosphere, productive use of natural capital, replacement of non-renewable natural resources with renewable ones, adaptation and improvement of ecosystems, creation of public assets, etc.) (Jackson, 2017), the designated investments can be legitimately considered as all types of property and

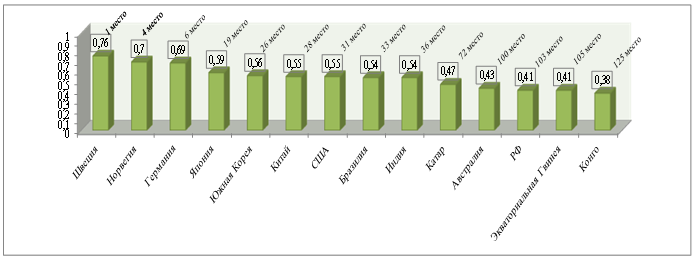

intellectual investments in economic activities that ensure that investors not only receive income, but also achieve a well-known environmental benefit and positive social change in the context of environmentally sustainable development. Such an approach to the essence of environmental investment forms a clear understanding: it is wrong to harm the environment with economic activity, as well as it is wrong to receive income from an environmental disaster. This means that environmental investments simultaneously generate de-investments, that is, withdrawal of funds and their transfer to other, environmentally safe industries, refusal to invest in securities and funds that carry out unethical or morally questionable activities from the perspective of the global ESG agenda (Animitsa, 2020; Fishman, 2019). And finally, in the context of ensuring long-term sustainable growth of TFP, environmental investments are adequate to the criteria and driving forces of the "fourth Industrial revolution" (Schwab, 2017) and the neo-industrial paradigm of modern development of Russia, justified even before the pandemic economic recession and external sanctions pressure on the Russian Federation by domestic scientists and economists (Gubanov, 2012; Daskovsky and Kiselyov, 2016). The conducted research testifies to the uneven progress even in the largest economies of the world in the field of policies and investments that ensure the formation of a "green" economy, which is clearly confirmed by the values of the Global Green Economy Index (Global Green Economy Index, GGEI). According to the results of the 2018 GGEI calculation, which was conducted across 130 countries in four parameters (leadership and climate change, efficiency sectors, markets and investments, environment), among the 5 largest economies, Germany (6th place; GGEI=0.69), Japan had the highest indicators in the overall index. (19th place with an index of 0.59), China (28th place; index=0.55); USA (31st place, with an index of 0.55) and India (36th place; with an index of 0.54) (Fig. 1).  Figure 1. Global Green Economy Index Figure 1. Global Green Economy Index

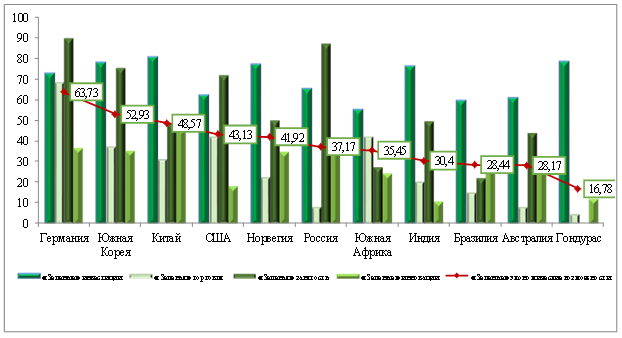

by countries of the world, 2018 Source: American consulting company Dual Citizen: official website. New York. URL:https://dualcitizeninc.com (accessed: 04.04.2022). Russia took only 103rd place in this rating (GGEI = 0.41), despite the 6th place in the world ranking according to the indicator "Green economic Opportunities" (Green Economic Opportunities), the value of which was 37.17%. For comparison: in Germany, the GEO value was 63.73, in China – 48.57 (Fig. 2).

Figure 2. Green economic opportunities some countries of the world, 2020 Source: GGGI Technical Report. 2020. No. 16 (accessed 04.04.2022). The need to recognize the ecological aspect of economic activity as imperative is indicated, among other things, by the sustainability in most countries of the world of such a negative trend as the increasing ecological footprint of humanity and/or the growing shortage of bio-capacity (our environmental assets) (Table 1). Table 1. Dynamics of the ecological footprint and the deficit (surplus) of bio-capacity per person in 2008-2018, gga | A country | Years | 2008 | 2009 | 2010 | 2011 | 2012 |

text1;mso-border-alt:solid black .5pt;mso-border-themecolor:text1;padding: 0cm 5.4pt 0cm 5.4pt'> 2013 2014 | 2015 | 2016 | 2017 | 2018 | | China | Bio-capacity per person | 0,88 | 0,88 | 0,9 | 0,9 | 0,91 | 0,9 | 0,9 | 0,93 | 0,92 | 0,92 | 0,92 | | Ecological footprint per person | 2,81 |

3,05 | 3,22 | 3,39 | 3,45 | 3,56 | 3,53 | 3,51 | 3,45 | 3,62 | 3,8 | | Reserve/bio-capacity deficit | -1,93 | -2,17 | -2,32 | -2,49 | -2,54 | -2,66 | -2,63 | -2,58 | -2,53 | -2,7 | -2,88 |

mso-border-themecolor:text1;border-top:none;mso-border-top-alt:solid black .5pt; mso-border-top-themecolor:text1;mso-border-alt:solid black .5pt;mso-border-themecolor: text1;padding:0cm 5.4pt 0cm 5.4pt'> South Korea Bio-capacity per person | 0,7 | 0,7 | 0,68 | 0,67 | 0,65 | 0,66 | 0,66 | 0,65 | 0,65 | 0,65 | 0,64 | | Ecological footprint per person | 5,7 | 5,42 | 5,86 | 5,9 | 5,76 | 5,73 | 5,64 |

mso-border-bottom-alt:solid windowtext .5pt;mso-border-right-alt:solid windowtext .5pt; padding:0cm 5.4pt 0cm 5.4pt'> 5,77 5,88 | 6,17 | 6,32 | | Reserve/bio-capacity deficit | -5 | -4,72 | -5,18 | -5,23 | -5,11 | -5,07 | -4,98 | -5,12 | -5,23 | -5,52 | -5,68 | | Germany | Bio-capacity per person | 1,8 | 1,82 | 1,76 |

mso-border-bottom-alt:solid windowtext .5pt;mso-border-right-alt:solid windowtext .5pt; padding:0cm 5.4pt 0cm 5.4pt'> 1,65 1,7 | 1,72 | 1,78 | 1,7 | 1,63 | 1,6 | 1,49 | | Ecological footprint per person | 5,57 | 5,15 | 5,55 | 5,42 | 5,22 | 5,24 | 5,06 | 4,95 | 4,83 | 4,81 | 4,67 | | Reserve/bio-capacity deficit |

150%'> - state guarantees in the form of subsidies for reimbursement of part of the cost of paying interest on loans and borrowings attracted by private investors for the implementation of environmental projects. - providing a set of benefits and preferences (for example, tax benefits and deductions, preferential rates on loans) to enterprises that process waste using circular technologies and supply secondary raw materials with improved environmental qualities, and, conversely, creating conditions under which it becomes economically unprofitable for the waste owner to store waste (waste collection and disposal tax); 4) improving the environmental literacy of the population and business: understanding by business what harm to the environment and human health is caused by today's production concept; preparedness of public consciousness in this matter. Conclusions The conducted research makes a certain contribution to the development of the theory of endogenous economic growth by taking into account the impact of environmental investment, initially focused on the efficient use of natural capital, on the maximum involvement of waste resources in economic turnover, the replacement of traditional technologies with environmentally friendly or low-carbon, ecosystem improvements, etc., on the production potential of the economy, on environmental quality and social changes. Summarizing the above, we consider it necessary to note that the increment of scientific knowledge of this study is as follows: 1) in the promotion and theoretical substantiation of the scientific idea of the objective need to activate environmental investment in post-pandemic Russia in order to overcome the "anti-sustainable environmental trends" that have developed here and ensure radical transformations of its economy in accordance with the ESG agenda. 2) in the theoretical substantiation of the scientific hypothesis that environmental investments, in the conditions of planetary manifestations of environmental growth constraints, should be recognized as a key factor in ensuring long-term sustainable growth of aggregate factor productivity (TFP). The article contains original scientific judgments on the impact of environmental investment on the activation of "green" innovations (environmentally friendly technologies or waste-free technologies; new high-tech products obtained as a result of industrial reproduction of raw materials, etc.); 3) in the formulated minimum necessary economic tools of state policy in the field of stimulating environmental investment in modern Russia. Note that the subject area of environmental investment is still in its infancy. In this regard, the authors of this study will have to study more deeply the nature and features of environmental investments (new investment conditions, the rate and nature of profit, payback periods, the structure of the capital market, etc.) in order to more clearly specify the mechanisms of their impact on economic growth and transformation of the economy and society.

References

1. Spence M. (2021). High Growth Sectors in the Post Recovery Decade. Project Syndicate. Available at: https//www.project–syndicate.org (commentary/post–covid–high–grouth–sectors–6y–michael–spense–2021–04.2021.

2. Jackson T. (2017). Prosperity without Growth? Foundations for the Economy of Tomorrow. United Kingdom: Rout ledge. 350p.

3. Gubanov S. (2014). Novaya industrializaciya i sektor reciklinga // Ekonomist. ¹12. S. 3-11.

4. Jackson T. (2009). Prosperity without Growth: Economics for a Finite Planet United Kingdom: Earth can Publications Ltd. 286 p.

5. Gubanov S. (2012). Derzhavnyj proryv. Neoindustrializaciya Rossii i vertikal'naya integraciya. Moskva. 223 s.

6. Glaz'ev S. YU. (2018). Ryvok v budushchee. Rossiya v novyh tekhnologicheskom i mirohozyajstvennom ukladah. («Kollekciya Izborskogo kluba»). M.ZH Knizhnyj mir. 768 s.

7. Fyuks R. (2019). Zelenaya revolyuciya : Ekonomicheskij rost bez ushcherba dlya ekologii / Per s nem. Moskva: Al'pina nonfikshn. 330 s.

8. Bobylev S. N. (2020). Ustojchivoe razvitie: novoe videnie budushchego? // Voprosy politicheskoj ekonomiki. ¹1 (21). S. 67–83. DOI: 10.5281/zenodo.375332

9. Suharev O. (2019). Investicionnaya model' ekonomicheskogo rosta i strukturnaya politika // Ekonomist. ¹1, S. 23–52.

10. Animica E. G., Dvoryadkina E. E., Kvon T. M. (2020). Preobrazuyushchie investicii – mejnstrim razvitiya regiona // Vestnik Belgorodskogo universiteta kooperacii, ekonomiki i prava. ¹ 4 (83). S. 83–95.

11. Fishman L. G., Mart'yanov V. S., Davydov D. A. (2019). Rentnoe obshchestvo: v teni truda, kapitala i demokratii. Moskva. 416 s.

12. Suharev O., Voronchihina E. (2020). Strukturnaya dinamika ekonomiki: vliyanie investicij v starye i novye tekhnologii // Ekonomicheskie i social'nye peremeny: fakty, tendencii, prognoz. T. 13. ¹4. S. 74–90. DOI : 10. 15838/esc.2020.4.70.4

13. Spence M. (2012). The Next Convergence: The Future of Economic rough in Multispeed World. NJ.: Farrar, Straus and Giroux. 320p.

14. Gordon R. and Mokyr J. (2016). «Boom vs. Doom : Debating the future of the US Economy», debate. Chicago : Council of Global.

15. Damianova A., Guttierez E., Levitanskaya K., Minasyan G., Nemova V. (2018). «Zelyonoe finansirovanie» v Rossii: sozdanie vozmozhnostej dlya «zelenyh» investicij / Analiticheskaya zapiska. Gruppa Vsemirnogo banka. M., 110 s.

16. Banerjee A., Duflo E. (2019). Good Economics for Hard Times Batter Anvers to our Biggest Problems. U. S. : Public affairs. 432 p.

17. Gordon R. (2016). The Rise and Fall of American Growth. N. Y.: Princeton University Press. 784 p.

18. Kormishkina L. A., Kormishkin E. D., Sausheva O. S., Koloskov D. A. (2021). Economic Incentives for Environmental Investment in Modern Russia // Sustainability. T. 13. ¹21. DOI : 10.3390/su132111590

19. Spiridonova A. V. (2020). Ekologicheskoe investirovanie v Rossijskoj Federacii: teoretiko–pravovoj podhod // Bulletin of the South Ural State University. Ser Law. Vol. 20. ¹1. P. 72–79. DOI : 10.14529/Caw 200111.

20. SHvab K. (2017). CHetvertaya promyshlennaya revolyuciya / Per. s angl. M.: Eksmo. 208 s.

21. Daskovskij V. B., Kiselev V. B. (2016). Novyj podhod k ekonomicheskomu obosnovaniyu investicij. M.: Kanon+; ROON Reabilitaciya.

22. Keynes J. M. The General Theory of Employment, Interest and Money. Create Space Independent Publishing Platform. Available at: http://www.library.fa.ru/files/ generaltheory.pdf.

23. Pittel K., Amigues J-P., Kuhn T. (2010). Recycling under a material Balance constraint Resource and Energy Economics. Vol. 32. ¹3. P. 379–394.

24. Griffiths W.E., Hill R. C., Judge G. G. (1993). Learning and practicing econometrics. Wiley, N.Y. P. 688–692.

25. Ivanova I. A., Busalova S. G., Gorchakova E. R. (2021). Regional'nyj investicionnyj rynok v sfere obrashcheniya s othodami: dinamika, struktura, metodika ocenki // Regionologiya. T. 29. ¹4. S. 840–865. DOI : https://doi.org/10.15507/2413- 1407/117/029/202104/840-865

26. Mirkin YA. (2020). Kak protivostoyat' recessii: chto delat' // Nauchnye trudy Vol'nogo ekonomicheskogo obshchestva Rossii. T. 223. ¹3. S. 188–196. DOI: 10.38197/2072-2060-2020-223-3-188-196.

Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the study. The article is devoted to the study of the development of environmental investment in the context of ensuring the stimulation of progressive and sustainable economic growth in the Russian Federation. Research methodology. The author uses both general scientific research methods (analysis, synthesis, comparison) and special economic and mathematical methods (in particular, mathematical modeling and econometric assessment). Moreover, there are a lot of graphic objects in the article, which made it possible to visually present the scientific results obtained, which significantly increased the attractiveness of this article with a potential readership. The relevance of the study is beyond doubt, since both issues of environmental development of the state and issues of stimulating sustainable economic growth are key challenges of our time. Moreover, the solution of both issues contributes to ensuring the achievement of the national development goals of the Russian Federation, as defined in the Decree of the President of the Russian Federation dated July 21, 2021. Scientific novelty. The reviewed article has a high level of scientific novelty. In particular, the results of a comparative analysis of the Sustainable Development Goals and priority areas of environmental investment are presented. The author also prepared trend models (growth curves) for the analysis and forecasting of the dynamics of investments in fixed assets in the Russian Federation aimed at environmental protection and rational use of natural resources. Moreover, the economic toolkit of state policy in the field of stimulating environmental investment in modern Russia has been formulated, but it is recommended to further refine it, assessing the specific social and economic effects of the implementation of the author's recommendations. Style, structure, content. The style of presentation of the material in the reviewed article is scientific. The structure of the article is built logically and harmoniously: in the introduction, the author of the article substantiates the relevance and subject of the study, then consistently justifies the presence of problem areas (including using mathematical apparatus and graphical representation of the results obtained) and formulates proposals for their solution. The content of the article, in general, corresponds to the title of the article, but the text does not indicate what constitutes "progressive economic growth" and "sustainable economic growth". On the one hand, these concepts are often used in scientific literature and do not complicate the general understanding of the author's scientific thoughts, but at the same time, the justification of key terminological units in the context of the stated topic would improve the quality of this article to an even higher level. Moreover, it is not customary to use the abbreviation "RF" in scientific research. It is recommended that the name of the State be given in strict accordance with article 1 of the Constitution of the Russian Federation. Bibliography. The author has studied a wide range of domestic and foreign scientific publications on the topic of the article, but given the popularity of this topic among Russian and foreign scientists, the number of publications in 2021 and 2022 seems insufficient. Moreover, the list of sources does not include sources of numerical data on which the empirical part of the scientific research was based. It is recommended to eliminate this remark. Appeal to opponents. Despite the fact that there are serious references to other scientific research in the text, especially when determining the subject and relevance of the research, the comparison and subsequent discussion of the results obtained by the author with the scientific results of other scientists is not given in the reviewed article. Conclusions, the interest of the readership. The article is of great interest to a wide readership and is recommended for publication after correcting certain errors noted in this review.

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.