|

DOI: 10.7256/2454-065X.2022.6.38161

EDN: LVJCKP

Received:

27-05-2022

Published:

30-12-2022

Abstract:

The subject of the study is the essential aspects and signs of the relations of interested users that develop in the process of developing the policy of tax accounting of agro-industrial processing organizations to assess the possibilities of optimizing value added tax (VAT). The purpose of the study is the theoretical justification and methodological support of the accounting tax policy from the point of view of the optimization processes of taxation of the object of research - the added value of processing organizations. The solution of the following tasks contributes to the achievement of this goal: to reveal the essence and content of the varieties of value added; to describe the features of VAT tax accounting in processing organizations of the agro-industrial complex; to substantiate the directions for improving the accounting tax policy of the object of research; to develop optimization measures for the policy of tax accounting. The methodological basis of the research is the methods that reveal the logic of the presentation: ideological – dialectical, deductive, inductive; general scientific - systemic; private scientific – statistical, analysis, comparison. The scientific novelty of the research consists in the development of methodological provisions of a recommendatory nature aimed at developing the policy of tax accounting of the object of research. The following provisions have the status of scientific increment: 1) the concept of "accounting tax optimization" is clarified, which is considered in contrast to traditional approaches, based on the trinity of essential characteristics of optimization processes; 2) methodological tools for improving the accounting tax policy on VAT in processing organizations of the agro-industrial complex are proposed, which differ from existing techniques and methods by eliminating contradictions between the accounting tax policy adopted by the organization and the methods of conducting tax accounting based on the implementation of regulatory legal opportunities: 1 - the content of the register of tax accounting and distribution of input VAT between taxable and non-taxable results of processing production is justified; 2 - the list of provisions of the accounting tax policy on VAT is characterized. The application of these recommendations in the course of forming a policy of value-added tax accounting and its optimization in processing organizations of the agro-industrial complex will contribute to increasing the tax solvency of these business entities.

Keywords:

processing organizations, APK, accounting policy, tax accounting, value added taxation, optimization, tax register, tax deduction, VAT, taxpayer

This article is automatically translated.

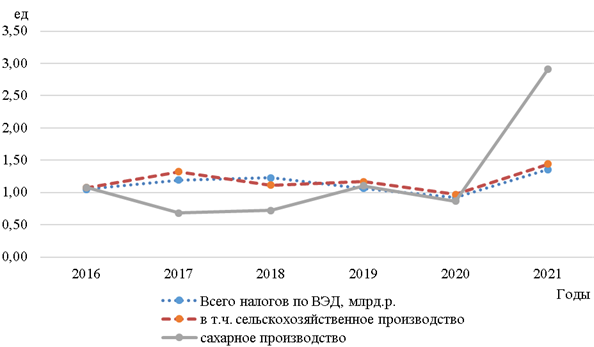

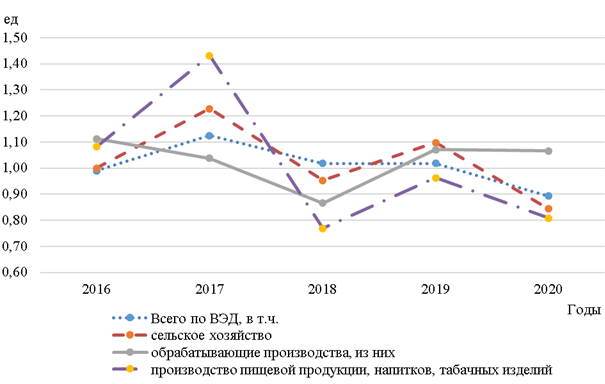

IntroductionIn the course of their economic activity, processing organizations of the agro-industrial complex are obliged to develop, adopt, formalize in the form of a special Order and supplement and/or change, if appropriate, the accounting policy for tax purposes. Accounting tax policy, as it is known, is an intra–organizational regulatory act containing a system of specific for a particular type of activity and distinctive political approaches used in similar business entities, due to the variety of ways to optimize taxation. Thus, the risk–oriented approach is being implemented in the accounting tax policy (UNP), which has recently become the basic basis for its formation in agricultural production organizations [27, p. 128]. We believe, in contrast to the existing system of scientific views on this definition, that modern Russian accounting tax policy is a harmonious system of options with two dual principal features: the first characterizes the containment of the aspirations of organizations to reduce the mass of taxes paid to achieve a balance of intra–company interests and fiscal needs of the state; the second provides a counterbalance to the right of the organization as a taxpayer to seek and apply optimization measures that make it possible in a legally justified way to withhold part of taxes (save) and then use them as working capital for the current financing of their economic activities. As part of the tax burden of the above-mentioned organizations, the largest share (more than 50%) is income tax and VAT, which are leaders in the complexity of calculation and optimization, which cannot but affect the content of accounting policy. Over the past 5 years, the rates of dynamics of tax payments (in aggregate) by types of economic activity (FEA) of agro-industrial processing organizations have had an insignificant scale of variation (except for 2021 due to the prevailing influence of environmental factors), in contrast to the rates of dynamics of the tax burden on average for FEA, which is clearly illustrated by the materials of Tables 1-2, Figures 1 and 2. For individual processing organizations of the agro–industrial complex of the food profile, a high tax burden is characteristic (above the threshold value provided for manufacturing industries), the average level of which is 2.7 times ahead of the same indicator for other production entities during the study period, and its growth rate is 4 times. However, in organizations engaged in the processing of sugar beet, meat, milk, it is significantly lower than the average by 4-5 times. Such circumstances indicate the need for closer attention to the accounting tax policy and the directions of its continuous improvement, since the amount of the actual tax burden indicates the suboptimality of the tax accounting policy. To ensure compliance with the conditions of reliability and objectivity in the course of the study, ideological, general scientific and private scientific methods (means of cognition), materials (sources) in the form of information obtained from special publications, regulatory legal documents, statistical tax data, etc. were used. At the same time, the accounting tax policy in the broad sense of the views was understood as a system of options, which, firstly, should restrain the desire of the organization to reduce the mass of taxes paid, that is, to ensure a balance of interests of the state and the organization; secondly, to have the right to oppose the fiscal authority with their optimization tax decisions, allowing to legally withhold part of taxes and use they are used as their own working capital. Table 1 – VAT payments by type of economic activity (FEA) of the Russian Federation (2015-2021) | Indicator | Years | | 2015 | 2016 | 2017 | 2018 | 2019 |

2020 | 2021 | | Total VAT on foreign economic activity, billion rubles. | 2589,4 | 2808,3 | 3233,4 | 3762,4 | 4486,6 | 4490,5 | 5789,4 | | including food production | 136,34 | 147,6 | 74,6 | 87,0 | 80,3 |

59,9 | 43,2 | | including sugar production | 3,4 | 3,5 | 3,2 | 0,7 | 1,8 | 0,2 | 4,6 | The methodological basis of the research was the following methods: dialectical – to explain the sequence of exploratory actions regarding the subject of the field of study; deduction and induction – to confirm the need for a theoretical justification of practical approaches to optimization procedures as the purpose of the study; systemic - to ensure the interrelationships and interdependencies of the views presented on the subject of research in the context of: diverse quantity ? obvious quality; analysis and synthesis – to ensure the economic logic of the construction of research steps and the reliability of summarizing conclusions in the course of solving the research tasks; statistical, graphic, comparison – to provide visual confirmation of the relevance of the research topic; historical - to establish the role and degree of development of the processes of formation of the subject of research. Table 2 – Tax burden by type of economic activity (FEA) of Russia (2015-2021, annual averages, %) | Indicator | Years | | Pace speakers, units. |

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | | | Total for foreign economic activity, including | 9,7 | 9,6 | 10,8 | 11,0 | 11,2 | 10,0 | 10,4 | 1,042 | | agricultural industry |

3,5 | 3,5 | 4,3 | 4,1 | 4,5 | 3,8 | 4,7 | 1,070 | | manufacturing industries, including | 7,1 | 7,9 | 8,2 | 7,1 | 7,6 | 8,1 | 7,4 | 1,003 | | production of food products, beverages, tobacco products |

18,2 | 19,7 | 28,2 | 21,7 | 20,9 | 16,9 | 17,6 | 1,012 | | | | | | | | | | | | |

Figure 1 – Rates of dynamics of tax payments on foreign economic activity in the Russian Federation, units (2016-2021) Thus, the purpose of the accounting tax policy should be considered its objective ability to explain to interested users of tax reporting, on the basis of which rules and how well it is formed. Therefore, the accounting policy for tax purposes serves as the only information source declaring the methods and methods of VAT accounting chosen by the processing organization-the taxpayer of the agro-industrial complex for the tax period.

Figure 2 – Rates of dynamics of the tax burden on foreign economic activity in the Russian Federation, units (2016-2020) The main part (justification) In the process of forming an accounting tax policy, it is necessary to take into account the attributive circumstances affecting its structural, substantive and qualitative characteristics. To a certain extent, this refers to a clear idea of: 1) the requirements for the content of the provisions of the accounting tax policy prescribed in the local organizational document-order; 2) the properties that give it a special status in the accounting process; 3) the features that are inherent only to it and need due attention, since they are regulated, and also the specific and distinctive features that take place regarding the accounting policy in a particular business. The first 2 attributes – requirements and properties – characterize the breadth of scientific views on the definition of "accounting tax policy", the third attribute reflects the need to characterize the components inherent only in accounting policy for the purposes of value added taxation (VAT) in the processing organizations of the agro-industrial complex in the narrow (purely specific) sense of this definition. 1. The main requirements for the accounting tax policy are the following: 1) disclosure of the provisions of tax accounting in the form of a political choice of the method of implementation of the accounting tax process; 2) obtaining the necessary information about income, expenses, property, obligations for tax purposes;

3) formation of the necessary information for internal and external users to master and control the completeness and correctness of the determination of taxes, the timeliness of their accrual and payment. 2. From the content of paragraph 2 of Article 11 of the Tax Code of the Russian Federation, three important properties follow that characterize the accounting tax policy as a separate political act in the accounting system of organizations: 1) the process of determining the tax base includes not only the recognition of income and (or) expenses, their valuation, distribution and the establishment of other facts of the taxpayer's economic life necessary for tax purposes; 2) the choice of one of several options that determine the procedure for calculating the tax base, regulated by tax legislation; 3) the selected methods of tax accounting are used by the organization, including all its structural divisions, in the tax period. 3. It is necessary to highlight the following features of the development of accounting policy for tax purposes in relation to the surveyed organizations that have the status of scientific increment, since for the first time the specifics of internal administration and optimization of VAT are outlined in the processing business of the agro-industrial complex. 1. The first feature is the need for organizations to adopt policies for tax purposes. According to paragraph 5 of Article 313 of the Tax Code of the Russian Federation, tax accounting procedures are carried out by the organization in accordance with the accounting tax policy and approved by the order (order) of the head. Therefore, the organization must adopt an appropriate document – an order (order) on accounting tax policy, set out on paper and signed by the head, that is, two accounting policies should be developed in the organization: for accounting purposes and tax. They can be created both in the form of separate orders, and in the form of special sections of one order on the accounting policy of the organization. The first form is preferable when an organization is engaged in various types of economic activities or has several business units, which is very typical for processing organizations of the agro-industrial complex. However, as practical studies show, some processing organizations of the agro-industrial complex do not pay the necessary attention to this type of accounting activity and do not develop sound tax accounting policies, which leads to confusion and distortions in tax accounting due to the unreasonableness of the application of certain usage norms established by tax legislation. 2. The second feature of the accounting tax policy of organizations is the establishment of the main methodological approach to tax accounting. Among the existing such methodological approaches in processing organizations , the following can be distinguished: 1) the implementation of tax accounting separately from accounting, since some rules of these types of accounting may not coincide in some cases; 2) combining accounting and tax accounting, that is, maximum harmonization of the accounting process, since some rules of these types of accounting may coincide in some cases. 3. The third feature of the accounting tax policy of organizations is its methodological connection with tax innovations. So, before developing an accounting tax policy in a processing organization, we recommend that you carefully study the innovations of tax legislation that come into force for the new tax period, some of which may affect the content of certain sections of the "Order on Accounting Tax Policy". It should be emphasized that innovations regarding the norms of tax law, as a rule, have an impact on the content of an intra-organizational document on tax accounting policy in different economic directions: 1) innovations can initiate changes (tactics); 2) innovations can initiate additions (tactics); 3) innovations can initiate a radical revision of the political provisions for the new tax period (strategy). Therefore, the methods adopted by the processing organization in the accounting tax policy are not unified methods of the accounting process, since they characterize only the main accepted methods of tax accounting, and can be changed and supplemented in accordance with the norms of law. An argument in favor of this statement can be the fact that the innovations of tax legislation that are coming out may contain provisions that cancel the previous or introduce new methods of tax accounting. 4. As an essential and fourth feature of accounting policy, the following can be put forward – its reactive effect on the amount of the tax burden, manifested in the following reaction characteristics: 1) if the accounting tax policy is not optimized, then the amount of the actual tax burden in the processing organization significantly (>10%) exceeds the amount of the tax burden on average by type of economic activity in accordance with the updated data in the Order of the Federal Tax Service of the Russian Federation dated 30.05.2007 ¹MM-3-06/333@; 2) if the accounting tax policy is not perfect due to the violations and distortions allowed, then the amount of the actual tax burden in the processing organization is significantly (>10%) less than the amount of the tax burden on average by type of economic activity in accordance with the updated data in the Order of the Federal Tax Service of the Russian Federation dated 30.05.2007 No.MM-3-06/333@.

However, it should be emphasized that the methodology for determining the tax burden on average by type of economic activity needs to be improved, since among the data given in the Order of the Federal Tax Service of the Russian Federation dated 30.05.2007 No.MM-3-06/333@, seasonal (except for catch and processing of fish) are not allocated as part of food production, to which, of course, it is necessary to include, for example, sugar production, where there is a pronounced seasonality. The information given in table 2 is a clear argument in favor of the above statements. The greatest difficulty, as found, is the justification of the approach that is used to form sections of accounting policy. Sadchenko K.G. formulated three main approaches that should be guided during the development of accounting policy for tax purposes: to rely on existing legislative norms; not to apply the only possible accounting method in accounting policy; to anticipate the positive economic effect of the choice made regarding the accounting option [28]. As a rule, other authors also recommend this approach to the formation and/or modification of the provisions of the accounting tax policy [15; 16; 18; 20], which, of course, is not the subject of scientific discussion due to the immutable legality of these declarations. However, it can be noted that the list of the above approaches is limited, since there is a significant omission regarding the need for mandatory use as a preliminary element of the process of developing accounting tax policy – the study and taking into account specific (in comparison with other foreign economic activities) and distinctive (in comparison with other organizations within the boundaries of one foreign economic activity) conditions (as a sum of traits) characteristic of value-added taxation in the course of business operation and development. Thus, the following features are characteristic of agro-industrial processing organizations: 1) a high proportion of VAT deductions due to the seasonality of the production process and/or significant intra-annual fluctuations in demand for food products, respectively, affecting the volume of its production in direct proportion; 2) the application of VAT rates of 0%, 10%, 20% in almost all organizations engaged in the processing of raw materials of agricultural origin. In particular, the following VAT rates are applied in sugar production organizations in Russia: the 0% rate (Clause 1 of Article 164 of the Tax Code of the Russian Federation) is applied when exporting finished products, in particular sugar; the 10% rate is the main rate for sugar production organizations, applied when selling white sugar within the country, in accordance with the list of goods approved by subclause 1, clause 2, Article 164 of the Tax Code of the Russian Federation and Decree of the Government of the Russian Federation No. 908 dated 31.12.2004. The basis for applying the 10% rate is the availability of goods in the HS classification or OKPD2 classification. In accordance with the classification according to OKPD2 , the following positions are allocated for sugar production products: 10.81.11 Raw beet sugar or cane sugar in a solid state; 10.81.12 White beet sugar or cane sugar and chemically pure sucrose in a solid state without flavoring or coloring additives; 10.81.13.110 White beet sugar in a solid state with flavoring additives; 10.81.19.110 Beet sugar or cane liquid; 10.81.19.120 Beet sugar or cane brown; the rate of 20% is for certain types of sugar products - pulp (by type), molasses. 3) inaccuracies in the preparation of invoices, initiating illegal tax deductions (overstatement or understatement) due to the large number of suppliers of basic and auxiliary materials, additional and basic raw materials and, especially, the variety of property rights of these business entities; 4) the structure of the tax burden and the share of VAT in it in food-related organizations is closely dependent on the types of products (the nomenclature of polyproduct industries), for example, in the meat processing and dairy processing business, where the nomenclature positions may differ significantly not only due to the specifics of the processed raw materials and assortment, but also by time periods or from- because of the sanctions pressure, that is, because of the limiting influence of environmental factors. In addition, the production of certain types of food products is either labor-intensive, material-intensive, or technical, which also affects the structural ratios of taxes; 5) VAT is not only an intra-company tax element, but also, in the fair expression of T.S. Keshinyan, acts as an important determinant of the pricing process in food production [14, p. 153]; 6) The initial complexity of the value-added taxation process due to the inconsistency in understanding the essence of the latter and especially its structural components, as well as the appearance of constant changes in the content of reporting (VAT declaration) and procedures for calculating deductions during the determination of the amounts of this tax to be transferred to the budget. Further, it should be noted that among the sections of the special document – the Order on accounting tax policy – one of the most complex in terms of the formation and disclosure of procedures for the tax accounting of value added in the context of specific requirements and features should take place. To ensure the requirements of completeness and relevance of the selected options in the accounting tax policy, it is necessary to have an idea of: the essence of this type of tax, its general features, the features of calculating and tax accounting of VAT in processing organizations of the agro-industrial complex.

Value added tax has been widespread in the economic activities of business representatives of the European Community (EU) since the sixties of the last century, in Russia – in the nineties without a corresponding lengthy preparation of the value added tax process. The introduction of VAT was due to a number of its specific properties as a tax, such as: 1) fiscal functionality, 2) entrepreneurial traits, 3) social traits. The advantages of the first property are the high external profitability of VAT, that is, the tax is important only for the state, the second group of properties is the relative independence of VAT from the volatility of the pace of development of entrepreneurship as a source of income, the third group – from the point of view of the socialization of the production process, end consumers (population) pay VAT unconsciously, that is, imperceptibly for themselves; the latter generates some antisociality of this tax, since the burden of paying this part of the consumer price is imposed on low-income people due to the fact that the mass of VAT in the expenses of these consumer subjects is a significantly larger part than in the expenses of high-income consumers. As a rule, issues related directly or indirectly to the UNP in value-added tax organizations are considered by Russian specialists regarding: 1) theoretical provisions of administration, calculation, accounting and payment of VAT [11; 26; 29]; 2 implementation of practical measures during the implementation of theoretical provisions on VAT accounting [8; 12; 18; 22]; 3) features of innovations that come into effect in the tax period and affect the content of the VAT accounting policy [13; 24; 25]; 4) problematic situations related to value added taxation [10; 14; 19; 21; 23]; 5) opportunities for making optimization decisions in the process of developing the provisions of the VAT accounting policy [17; 28]. In particular, Gashenko I.V., Orobinskaya I.V., Zima Yu.S., the issues of VAT tax administration for the purpose of forming trust relations in tandem "state bodies – an economic entity" [11, pp. 2-4]; Osina D.M. assessed the legal consequences of some innovations related to the acceptance of VAT deduction [23, p. 2, 5-6]; Timoshina T.A. developed directions for improving VAT refund methods [26, p. 36-40]; Artelnykh I.V. described significant features of VAT calculation in the execution of various business contracts [8, p. 75-77]. However, some provisions related to the systematic development of the VAT accounting policy remain without due attention. Foreign experts investigate issues related to VAT, as a rule, from the perspective of administration [1-7], which is a manifestation of the principle of non-interference in the private life cycle of entrepreneurship, including taxation policy. We consider this quite justified, given the openness of the nature of the business conditions of food production in developed foreign countries. At the same time, the accounting tax policy of Russian organizations remains without the attention of foreign researchers due, as it seems, to a narrow interpretation of the advantages and disadvantages of such business elements for corporate tax analysis processes. However, one cannot agree with the opinion of M. Boivallet, who believes that Internet sales, which are becoming more widespread (which we believe is a natural phenomenon), provoke the risk of tax evasion, including VAT [3]. For example, the introduction of an electronic bill of lading (ETN) into official circulation in Russia from 01.03.2022 by Decree of the Russian Federation No. 2116 dated 30.11.2021 and Article 2 of Federal Law No. 336-FZ dated 02.07.2021, the predominant feature of which is the need to send it to the state information system of electronic transportation documents, which allows proper external control over the correctness of taxation. added value (we are talking about the ASK-3 system). During the development of the provisions of the UNP on VAT, it is necessary to take into account the complexities of this type of taxation, primarily related to the object of taxation – value added. For objective reasons, the content of the latter as a definition in economic theory, accounting and tax accounting differ. From an economic point of view, value added is the value of sales reduced by the amount of material and equivalent costs and expenses going to domestic consumption. From an accounting and tax point of view, depreciation of assets (both tangible and non-tangible) is not included in the value added as an object of accounting and taxation. Since it is not possible to challenge the validity of the formula for determining the latter, it is necessary to take into account the priorities of accounting and tax understanding of value added when developing the provisions of the UNP on VAT. Taking into account the above circumstances, the following VAT accounting provisions are postulated, which must be recognized as determining when developing the relevant provisions of the accounting tax policy in the processing organizations of the agro-industrial complex. 1. Separate accounting of the facts of economic life (FHJ). In accordance with paragraph 4 of Article 149 of the Tax Code of the Russian Federation, organizations that commit FGJ that are subject to and not subject to VAT (that is, are exempt from this type of taxation) are required to keep separate records of these facts. If this does not happen, the exemption from VAT of the relevant facts of economic life is not provided. At the same time, the methodology of separate accounting of the amounts of "incoming" VAT becomes particularly difficult. Since this procedure is not prescribed by the rules of law, it needs to be fixed in the UNP, relying on the provisions of paragraph 4 of Article 170 of the Tax Code of the Russian Federation. In other words, the corresponding paragraph of the "Order on accounting tax policy" should fix the procedure for dividing the amounts of "outgoing" VAT into two groups: 1) VAT amounts subject to refund or increasing the cost (direct method); 2) VAT amounts subject to deduction or increasing the value – in proportion to the proportion in which the facts of economic life are subject to taxation or exempt from taxation.

Also in the Order it is necessary to prescribe the procedure for determining the 5% threshold of the total amount of total expenses for the purchase, production, sale of goods, works, services, property rights in the absence of separate accounting. The methodology of separate accounting of the facts of economic life itself must comply with the requirements of Article 166 of the Tax Code of the Russian Federation. It can be developed based on the following principles: 1) analytical interpretation of sub-accounts (second order) of certain accounting accounts; 2) allocation of separate sub-accounts of certain accounting accounts; 3) an appendix to the relevant tax registers. 2. Exemption of the facts of economic life from VAT. In accordance with paragraph 5 of Article 149 of the Tax Code of the Russian Federation, an organization may refuse or suspend the procedure for imposing VAT on facts of economic life related to the sale of goods, performance of works, provision of services provided for in paragraph 3 of Article 149 of the Tax Code of the Russian Federation, but for a period of at least one year. Therefore, it is necessary to submit to the tax authority (within the appropriate time) an application for refusal of exemption from VAT. In addition, in accordance with sub-paragraph 1 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation, VAT is levied at a rate of 0% when selling goods for export, as well as those in the free customs zone exported under the re-export procedure, which previously related to previous conditions, including waste received during processing or residues of such goods, but at the same time, in accordance with Article 165 of the Tax Code of the Russian Federation, this must be confirmed by the necessary documents. It should be noted that the taxpayer organization has the right in some cases, regarding the export of goods, works, services carried out in the export customs procedure, not to apply the 0% rate; for this you need to make an appropriate application to the tax service, as prescribed in paragraph 7 of Article 164 of the Tax Code of the Russian Federation, for a period of at least one year. 3. The moment of determining the tax base. In accordance with clause 13 of Article 167 of the Tax Code of the Russian Federation, an organization has the right to determine in the UNP the moment of occurrence of the tax base as the day of shipment (transfer) of goods, performance of works, provision of services, but if there is a separate accounting of FHF in a long production cycle. In other words, keeping separate records in such a situation is mandatory, and in case of its absence, the above moment is determined in a generally established manner. At the same time , two documents must be submitted to the tax service: 1) confirmation of the duration of the production cycle (regulations approved by the Order of the Ministry of Industry and Trade of the Russian Federation dated 07.06.2012 No. 750); 2) a copy of the contract with the buyer certified by the signature of the head or chief accountant. 4. Preparation of accompanying accounting documents in the document management system. In accordance with clause 6 of Article 169 of the Tax Code of the Russian Federation, a taxpayer organization is obliged to draw up an invoice, including in electronic form, approved by Order of the Federal Tax Service of the Russian Federation No. MMV-7-15/820@ dated 19.12.2018. In the Order on the accounting tax policy in this regard, it is necessary to approve the list of persons entitled to sign invoices. Also, the list of persons entitled to sign sales and purchase books is fixed in the UNP, if they are not signed by the head. It should be emphasized that invoices must contain the relevant details listed in Article 169 of the Tax Code of the Russian Federation, only in this case the organization will be entitled to tax deductions. The rules for filling out, issuing and receiving invoices and their forms, including in electronic form, are regulated by Decree of the Government of the Russian Federation No. 1137 of 12/26/2011, Order of the Ministry of Finance of the Russian Federation No. 174n of 10.11.2015, Order of the Federal Tax Service of the Russian Federation No. MMV-7-15/820@ of 12/19/2018, Order of the Federal Tax Service of the Russian Federation No. MMV-7 of 04.03.2015-6/93@. In addition, the accounting tax policy should reflect the frequency of renewal of the numbering of invoices. Since there is no regulatory limitation of such terms, the taxpayer organization has the right to specify any of the options - once a month, a quarter, a year or others. Another important procedure concerning invoices is related to corrections made to them. As you know, even a minor error in the preparation of invoices, that is, non-compliance with the provisions of Article 169 of the Tax Code of the Russian Federation and Annexes 1 and 2 of the Decree of the Government of the Russian Federation No. 1137, may become the subject of a dispute with the tax authority over the refusal to apply the tax deduction. Therefore, the relevant corrections made to the invoice must be confirmed by the signatures of the head and chief accountant, and in other cases - by persons whose list should be specified in the Order on Accounting Tax Policy. 5. The need to make changes and additions to the content of the UNP, which arises due to permanent innovations in existing regulatory legal acts. In the process of developing the provisions of the UNP, it is necessary to take into account some innovations that begin to have legal force in the relevant tax period [13; 24; 25]. Firstly, until January 1, 2023, the period of exemption from VAT on the importation of certain categories of livestock into the territory of the Russian Federation has been extended in accordance with: Federal Law No. 375-FZ of 11/23/2020 and the All-Russian Classifier of Products by Types of Economic Activity and the facts of sale, transfer for their own needs of these types of products. Secondly, since March 1, 2022, the updated form of the bill of lading has entered into force in accordance with the Decree of the Government of the Russian Federation No. 2616 of 30.11.21, which now contains 12 sections. Of particular interest from a practical point of view is the assumption concerning the possibility of using such a bill of lading as a primary accounting document. For this purpose, it is necessary to make the 4th copy of this invoice, and on paper, in which it is indicated: 1) the cost of the service without VAT (total);

2) VAT rate; 3) the amount of VAT presented to the buyer; 4) the cost of the service with VAT (total); 5) the list of persons responsible for the registration of the facts of transportation (on the part of the shipper and carrier); 6) the date of signing the document. The importance of this innovation lies in the ability of the processing organization of the agro-industrial complex to take into account transportation costs for tax purposes in accordance with the letter of the Federal Tax Service dated 04/19/2011 No. SD-4-2/5238@. Thirdly, since 01.03.2022, the document "Electronic Bill of Lading" has been put into official circulation in accordance with Resolution No. 2116 and Article 2 of the Federal Law of 02.07.21 No. 336–FZ, mandatory application of which will be from 2023. The form of this document consists of 4 mandatory exchange files concerning the actions of the shipper and the carrier, when signing it, two options can be used - a simple electronic signature and an enhanced unqualified signature followed by an enhanced qualified electronic signature of the carrier. A distinctive feature of the application of such a document is the need to send it to the state and information system of electronic transportation documents. Fourth, the innovations introduced by Federal Law No. 323-FZ dated 14.07.2022 regulating the procedure for VAT payment from 01.01.2023 include the establishment of a new term for this fact: the 28th of each of the three months that follow the past tax period, in accordance with the updated version of paragraph 1 of Article 174 of the Tax Code of the Russian Federation. Fifthly, the procedure for VAT refund has changed in accordance with Article 176 of the Tax Code of the Russian Federation – the amount of VAT deductions exceeding the total amount of tax calculated on taxable FHF (facts of economic life) following the results of the tax period is subject to reimbursement in three ways: 1) offset against future payments; 2) repayment of debt; 3) refund to the taxpayer's settlement account. It is necessary to note a very important circumstance connected, in accordance with the new paragraph 28 of paragraph 2 of Article 11 of the Tax Code of the Russian Federation, with the emergence from 01.01.2023 of the balance of the unified tax account (ENS), the main purpose of which is to recognize the amounts recorded on it for return to the settlement account or to offset against future payments, only in the case of the formation of the positive balance of the ENS. In addition, the refund procedure has changed – the tax must be returned within five working days from the date of receipt of the decision to cancel the VAT refund in accordance with paragraph 3 of Article 5 of Law No. 263-FZ. However, it should be noted that not all introduced innovations can directly or indirectly affect the content of the sections of the UNP processing organizations of the agro-industrial complex. In particular, the first, second and fourth of the listed innovations on VAT cannot be reflected in the Order on the UNP due to the unambiguity of the interpretation. Regarding the third of the listed, we can say the following: until 01.01.2023, an item on the use or non-use of an electronic bill of lading should be included in the accounting policy of this type, from 01.01.2023 this item should be excluded, since the use of the named primary document will become a mandatory fact. Regarding the fifth of the noted innovations, it will be necessary to make a choice of one of the permitted options and reflect it with the appropriate paragraph in the Order on the UNP. 6. The procedure for calculating the value added tax. Being an indirect tax, VAT performs only a fiscal function in the Russian Federation. At the same time, there are two ways of calculating VAT: the first, when the taxpayer determines the value added as a tax base, and then calculates VAT from it at the appropriate interest rate; the second, which is essentially considered a tax credit, involves the calculation of VAT by the taxpayer (when preparing a tax return) as the difference between VAT on realized results of activities and VAT on purchased goods (works, services) having the form of deduction. The latter method is used in Russia and is mandatory in accordance with paragraph 1 of Article 168 of the Tax Code of the Russian Federation. It should be noted that in both the first and second cases, sources of information of an internal confidential nature that are not subject to provision to state statistical bodies are used to carry out the relevant calculations. Therefore, it is impossible to assess the contribution of processing organizations to the added value of agricultural production organizations and the latter to the added value created by all production organizations in Russia. It is possible to calculate the added value only for any one processing organization and/or for a group of similar organizations that are part of the corresponding Holding or Group of Companies, for example, for sugar production organizations of the Voronezh region of Russia that are part of the PRODIMEX group of companies. But the results of such calculations can only be performed by an internal organizational analyst and presented, as a rule, to internal users, and to external users only with the consent of the owners, which is very problematic. Results The improvement of the accounting tax policy is directly related to the optimization of value-added taxation in the processing organizations of the agro-industrial complex. In particular, it can be considered justified that the UNP, which is reasonably optimized, has three properties noted by R.V. Nuzhdin and co-authors, which include: 1) the choice of a tax accounting option that ensures a safe tax burden; 2) the balance of tax and accounting that can ensure the effectiveness of the accounting service; 3) the possibility of using the relevant provisions of the UNP in the arbitration court as an additional and documentary argument in favor of a tool to prove the legality of measures to optimize taxation of a particular organization [9; 27].

At the same time, optimization decisions can also be made, focusing on the existing problems in this area identified by Artelnykh I.V., in terms of the uncertainty of the boundaries of tax optimization [8], described by Medvedev A.N. regarding insufficiently justified tax benefits [21], outlined by Osina D. M. about the consequences of using incorrect optimization methods [23]. Nevertheless, some publications devoted to tax optimization issues contain incorrect provisions. Thus, Lvova M.V. and Kuzmina A.L., describing one of the problematic optimization methods associated with the execution of fictitious contracts with suppliers, believe that in this way the "input VAT" is reduced, and this is the taxpayer's goal [19, p. 8]. We believe that the taxpayer in this case seeks, on the contrary, to increase "input VAT" to reduce the amount of VAT paid to the budget by increasing the amount of VAT deduction. Busheva A.Yu., characterizing the order of control procedures for the correctness of the accounting process of VAT calculations, identifies VAT with the value added itself [10, p. 13], although, naturally, it is not the value gain itself in the form of an addition that is withdrawn to the budget, as the author believes, but its part calculated according to the relevant tax formulas. Levshukova O.A. and Khandrimailo N.S., describing tax optimization measures, differentiate them by types, including depending on the industry, that is, the type of economic activity that the taxpayer is engaged in [17, p. 3]. We believe that such an approach is not a type, but an attribute of tax optimization due to its obvious necessity. Skorokhod K.P. connects the existence of the largest number of offenses during the optimization of the tax base by taxpayers with a rather complex mechanism for obtaining deductions and refunds, as well as VAT reporting. We consider it appropriate to recognize such factors as the exception rather than the rule in optimization processes. We believe that the optimization process has a trinity of essential characteristics, which can be formulated as a scientific increment as follows: optimization of the tax accounting policy is an essential element of the tax management of organizations, which must take into account the constant changes in the tax environment; the main goal of optimizing the tax accounting policy is to balance the business interests of organizations and the fiscal interests of tax authorities; tax accounting optimization should be carried out based on the properties of the object of taxation, in particular, value added, only in this case it is possible to obtain relevant evidence of tax benefits. Also, in the course of optimizing the accounting tax policy, it is necessary to take into account generalizations of the arbitration practice of applying the provisions of Article 54.1 of the Tax Code of the Russian Federation, which, as A.N. Medvedev believes in a timely manner, contains two hierarchical conditions for recognizing the legality of reducing the tax base by an organization or the tax itself paid to the budget [21, p. 102]: 1) prevention of distortions; 2) compliance with the main purpose of the transaction, the presence of fulfillment of obligations under the transaction by a person who is one of the parties to the contract. Nevertheless, the ambiguity of the interpretation of the concept of "distortion" allows for such a definition to use the concept of "unintentional counting error" in accordance with Article 81 of the Tax Code of the Russian Federation, as well as in accordance with the letter of the Federal Tax Service of the Russian Federation dated 15.04.2021 No. SD-4-3/5182@ to use the concept of "unreality of execution of the transaction by the parties" or "absence of the fact of its achievements". The study of practical materials characterizing the content of the accounting policy for VAT taxation purposes in organizations of the agro–industrial processing business (in particular, sugar factories, meat processing plants, dairy processing plants in 2020-2022) gives reason to state the following: elements of the accounting tax policy, in particular on VAT, are less aimed at minimizing tax risks caused by violations of current legislation, while they should be aimed at achieving a positive effect from tax planning; the advantages of tax optimization of VAT policy are often used as a justification for the promotion of banking products, in particular, leasing, but are not related to the content of tax policy; as a rule, the existing orders on accounting policy in the VAT section do not contain some important provisions for which variable accounting actions are provided for by the norms of law. The above facts characterizing the shortcomings of existing approaches to the formation and disclosure of VAT accounting policy determined the nature of the results of the study. Taking into account the above, some provisions are proposed for use as part of the Order on Accounting Tax Policy, which may contribute to its optimization. In particular, in the "Value Added Tax" section of the "Order on Accounting Policy", it is useful to reflect the following main provisions, which differ from existing techniques and methods by eliminating contradictions between the accounting tax policy adopted by the organization and the methods of tax accounting based on the implementation of regulatory legal capabilities, as well as focused on minimizing the risk of including processing organizations in the number of subjects subject to tax audit: 1) a list of facts of economic life for which separate accounting is established; 2) the methodology of separate accounting (in the appendix to the Order); 3) facts of economic life for which the right to exemption from VAT has been refused or suspended; 4) a list of facts of economic life for which separate accounting is established, but they are not objects of VAT taxation; 5) a list of facts of economic life that are subject to taxation at different tax rates, for which separate accounting is established; 6) maintaining separate accounting on the basis of:

allocation on separate sub-accounts of accounting accounts 90, 91, 62, etc.; reflections in the analytical accounting of the corresponding accounting accounts 90, 91, 62, etc.; creation of the relevant tax register as an appendix to the order; 7) a list of documents submitted to the tax service to confirm the 0% VAT rate for the sale of goods, performance of works, provision of services; 8) a list of facts of economic life, in respect of which the 0% rate is applied and the term (at least a year); 9) conditions for transferring the VAT deduction to a later period; 10) numbering of invoices for the sale of goods (works, services), property rights through separate divisions (if any) with the indication of the digital index through the dividing sign "/"; 11) list of persons entitled to sign: on invoices, including on adjustment invoices; in the sales books; implementation of internal control over the correctness of the sales book; 12) a list of persons responsible for maintaining the purchase book with the authority to control the completeness of filling in all the details of invoices, including corrective ones. However, it should be noted that, as a rule, it is when developing a complete list of items of accounting tax policy related to VAT that difficulties and omissions of important provisions arise, and not all tax accounting registers are reflected in the appendix to the "Order on Accounting Tax Policy" of agro-industrial processing organizations due to underestimation of their necessity. As such a necessary tax register, reasonably reflecting the results of tax accounting and the distribution of input VAT between taxable and non-taxable objects and having the ability to integrate into existing software products, a special form is proposed, given in Table 3. The form of this register is recommended to be used in such processing organizations of the agro-industrial complex as sugar, meat processing, dairy processing, since it it has the status of a scientific increment for the tax accounting system of agro-industrial processing organizations. Table 3 - Register "Methodology of separate accounting and distribution of input VAT between taxable and non–taxable results of activity (RD) for the quarter of 2023" (example of filling in the register is conditional for the processing organization of the agro-industrial complex) | | Indicator | Amount, thousand rubles. | | 1 The cost of goods shipped (works performed, services rendered), transferred property rights | | 1.1 | Revenue from the sale of goods specified in subclause 1 (except for raw materials) and subclause 6 of clause 1 of Article 164 of the Tax Code of the Russian Federation, subject to VAT at the rate of 0% | 900,0 | | 1.2 |

Revenue from the sale of goods (performance of works, provision of services, transfer of property rights – hereinafter referred to as RD) subject to VAT at the rate of 10% (excluding VAT) | 470000,0 | | 1.3 | Revenue from the sale of taxiways subject to VAT at the rate of 20% (excluding VAT) | 22000,0 | | 1.4 | Revenue from the sale of VAT-exempt taxiways | - | | 1.5 | Income in the form of interest on loans issued | 200,0 | | 1.6 | Income from the sale of securities | 20,0 | | 1.7 | "Tax" income from the sale of securities | - | | 1.8 | Market value of taxiways transferred free of charge |

100,0 | | 1.9 | The selling value of the RD (excluding VAT), the income from the sale of which will be recognized in subsequent periods | 300,0 | | 1.10 | Revenue from shipments (excluding VAT) taken into account when calculating the share in past tax periods | 400,0 | | 1.11 | Other income not related to sales | 100,0 | | 1.12 | The cost of the RD shipped as a whole for the tax period without VAT (p. 1.1 + p. 1.2 + p. 1.3 + p.1.4 + p. 1.5 – p. 1.6 + p. 1.7 + p. 1.8 + p. 1.9 – p. 1.10) | 493080,0 | | 1.13 | The cost of the shipped RD, the sale of which is subject to taxation (p. 1.1 + p. 1.2 + p. 1.3 + p.1.8 + p. 1.9 – p. 1.10) | 492900,0 | | 1.14 | The cost of the shipped RD, the sale of which is not subject to taxation (p. 1.4 + p. 1.5 – p. 1.6 + p. 1.7) |

180,0 | | 1.15 | The share of the value of the RD shipped, the sale of which is subject to taxation, in the value of the RD shipped as a whole (p.1.13 / p. 1.12 ? 100%) | 99,963 | | 1.16 | The share of the value of the shipped RD, the sale of which is not subject to taxation, in the value of the RD as a whole (p. 1.14 / p. 1.12 ? 100%) | 0,037 | | 2 The cost of the recorded input VAT and its distribution | | 2.1 | VAT on acquired OS and IA objects, subject to distribution between taxable and non-taxable activities, total | 400,0 | | 2.2 | VAT on purchased OS and IA objects, deductible from the budget (p. 2.1 * p. 1.15 / 100%) | 399,8 | | 2.3 | VAT on purchased OS and IA objects, taken into account in the cost of these objects (p. 2.1 * p. 1.16 / 100%) | 0,2 | | 2.4 |

VAT on acquired taxiways, subject to distribution between taxable and non-taxable activities, total | 46000,0 | | 2.5 | VAT on purchased taxiways, deductible from the budget (p. 2.4 * p. 1.15 / 100%) | 45983,0 | | 2.6 | VAT on purchased taxiways, taken into account in the cost (p. 2.4 * 1.16 / 100 %) | 17,0 | It should be noted that modern software products allow embedding the form of this register into the accounting activities of the organization with minimal costs, in particular, in the 1C:Enterprise program used by most processing organizations of the agro-industrial complex, as well as, for example, in the 1C 8UPP program "Sakhzavod Editorial CRT", used in sugar production organizations production. Further, some optimization measures for VAT related to tax accounting are considered, the applicability of which in the processing organizations of the agro-industrial complex is beyond doubt. 1. One of the current norms of the law of tax legislation requiring certain specification is the deduction of VAT amounts in respect of goods purchased by business entities in retail trade organizations. The position of the Ministry of Finance of the Russian Federation on the particular issue of the application of this norm is set out in letter No. 03-07-09/54634 dated 25.06.2020 on the example of buying gasoline at a gas station. In particular, it was noted that the Tax Code of the Russian Federation does not provide for the possibility of deducting VAT on such transactions without the presence of invoices. However, it should be noted that, firstly, this document is not a regulatory legal act, since, in accordance with the letter of the Ministry of Finance of the Russian Federation No. 03-02-07/2-138 dated 07.08.2007, it has an informational and explanatory nature. Secondly, in accordance with paragraph 1 of Article 172 of the Tax Code of the Russian Federation, a necessary and sufficient reason for deducting the amounts of VAT paid is the presence of invoices issued by sellers when an organization purchases goods (works, services). Based on the principle of possible compatibility of diverse provisions, it is recommended that production organizations of the agro-industrial complex conclude direct contracts with gas stations, which will make it possible to obtain a full package of documents for VAT deduction, including invoices, and, most importantly, to carry out this deduction. 2. In accordance with the current Order of the Federal Tax Service of Russia No. MM-3-06/333@ dated 30.05.2007, one of the criteria for assessing risks for organizations used by tax authorities in the process of selecting business entities for conducting on-site tax audits is the criterion - "the share of value-added tax deductions from the amount of tax accrued from the tax base for the period 12 months." At the same time, exceeding the level of 89% can be regarded by the Federal Tax Service as a basis for including an organization in the list of taxpayers subject to verification[1]. In order to minimize the risk of including an economic entity among those subject to tax audit, a taxpayer organization may use the right to deduct VAT within three years from the date of registration of purchased goods (works performed, services rendered) (clause 1.1. of Article 172 of the Tax Code of the Russian Federation), which will make it possible to reduce the share of deductions. At the same time, it should be borne in mind that in some cases this procedure for writing off VAT deductions is not provided by law[2]: for fixed assets, funds, intangible assets imported into the territory of the Russian Federation, equipment for installation; on advances issued and received; for travel expenses; according to the VAT of the tax agent.

For the correct exercise of this right, in our opinion, the following provisions should be disclosed in the tax accounting policy as a scientific increment: conditions for exercising the right to transfer the VAT deduction to a later period; the procedure for reflecting the procedures for splitting the VAT deduction in accounting documents. Let us explain these provisions in detail. As you know, the share of VAT deductions is not fixed (it may vary), since the business conditions of the economic activity of each agro-industrial processing organization differ in tax periods. Therefore, in order to improve the effectiveness of the application of optimization procedures for VAT, we recommend that taxpayer organizations monitor the values of the share of VAT deductions with the criterion of "89%". Additionally, for the purposes of intra-company tax control, this share can be compared with the values calculated according to the statistical tax reporting forms published by the Federal Tax Service. Thus, in the tax accounting policy of the processing organization of the agro-industrial complex, it is proposed to specify: "The organization carries out the transfer of the VAT deduction to a later (next) period, but not more than three years, if the estimated share of the deduction (at the end of the reporting period) for VAT) exceeds 89%." The right to transfer the VAT deduction on one invoice can be realized by the taxpayer organization both in full and in parts[3]. When splitting the VAT deduction, since the invoice is registered in different quarters, it is necessary in the purchase book: in column 15, specify the total cost of goods without dividing it into parts; in column 16, only the part of VAT that is presented for deduction in the current reporting period [4]. However, this approach cannot be applied to acquired and commissioned fixed assets (OS) and intangible assets (NA), since VAT deduction is carried out exclusively in full for these objects [5]. ConclusionsSummarizing the above, we can draw the following conclusions: VAT is the second most important tax as part of the tax burden of agro-industrial processing organizations, however, there are many problems associated with the reflection of VAT tax accounting in the accounting tax policy; there are a number of features of value added taxation that need to be taken into account during the development of the provisions of the accounting tax policy, including the main ones here are the innovations of tax legislation in force in the relevant tax period; the composition of the provisions relating to the VAT accounting policy is not closed, allows for changes and additions that meet regulatory requirements, but necessarily requires disclosure of methodological algorithms for conducting individual accounting and settlement procedures, which it is advisable to provide in the appendix to the "Order on Accounting Tax Policy"; It is not recommended to ignore the forms of the relevant tax registers, which are attributive accounting tax documents, as part of the appendix to the "Order on Accounting Tax Policy".; It is proposed to include a special item in the VAT accounting policy regarding the transfer of the VAT deduction to a later (next) period. The implementation of the above recommendations in the accounting tax practice of processing organizations of the agro-industrial complex will help to increase their tax solvency.

References

1. Andreeva, A. N. (2019). To the question of the expediency of raising the VAT rate. Taxes and taxation, 5, 1-12.

2. Antoshina, O. A. (2021). Accounting policy of the organization-2022: individual elements. Tax policy and practice, 11, 66-70.

3. Artelnykh, I. V. (2020). VAT-nuances in the execution of business contracts. Tax policy and practice, 5, 73-77.

4. Bryzgalin, A. V. (2021). Accounting policy of the enterprise for the purposes of taxation for 2021. Taxes and financial law, 2, 9-111.

5. Vasiliev, S. E. (2021). On determining the tax base for VAT in relation to subsidies received by the payer in order to compensate for lost income in connection with the granting of a discount by the lessee based on the price of the leased asset, including tax. Tax Policy and Practice, 7, 46-47.

6. Vasiliev, S. E. (2021). On the application of the VAT rate in relation to related services. Tax policy and practice, 11, 45-47.

7. Vachugov, I. V., & Martynov, O. N. (2021). Uncertainty of the boundaries of tax optimization-the problem of the Russian tax system. Taxes and taxation, 3. 118-129.

8. Gashenko, I. V., & Orobinskaya, I. V., & Zima, Yu. S. (2019). Achieving the efficiency of VAT tax administration in the context of atomization and digitalization of tax processes. Taxes and taxation, 11, 1-7.

9. Dneprova, A. B. (2021). Reflection in the declaration of non-taxable VAT operations. Accounting, 7, 66-71.

10. Changes in legislation on VAT, corporate income tax (2020). Tax policy and practice,1, 4-8.

11. Control over value added: development prospects for 2020-2023 (2020). Tax policy and practice,3, 4-7.

12. Krylova, L.P. (2021). Tax agent for VAT. Accounting, 5, 44-46.

13. Lisichkina, L. I. (2021). Deduction and recovery of VAT on fixed assets. Accounting, 6, 43-48.

14. Lisichkina, L. I. (2022). Separate accounting for taxation. Accounting, 3, 37-42.

15. Loginova, T. A., & Semkina, T. I. (2019). VAT adjustments for capital goods. Taxes and taxation,5, 70-77.

16. VAT: topical issues on the introduction of a traceability system for goods and work with tax gaps (2021). Tax policy and practice, 2, 18-22.

17. VAT: some issues of calculation, recovery, invoicing (2020). Tax policy and practice, 3, 18-21.

18. Osina, D. M. (2018). Consequences of applying the wrong tax rate on value added tax by the parties to the transaction. Taxes and taxation, 4, 1-6.

19. Osina, D. M. (2018). Problematic issues of compliance with the deadline for VAT deduction. Taxes and taxation, 5, 1-7.

20. Main changes in VAT legislation in the domestic market: what to look for (2021). Tax Policy and Practice,12, 28-32.

21. Petrova, V. Yu. (2021). New rules for VAT. Accounting, 9, 12-15.

22. Pinskaya, M. R., & Ivanov, A. (2019). Administration of value added taxation in the Eurasian space: a comparative analysis. Taxes and taxation,10, 19-24.

23. Rumyantseva, V. M. (2018). Risk-based approach as the basis for the formation of corporate accounting policy. Accounting. Analysis. Audit, 5(4), 120-130.

24. Rusakova, O. V. (2021). Value added tax on advances from the point of view of the constitutional court of the Russian Federation. Taxes and taxation.1, 1-7.

25. Rusakova, O.V. (2018). The legality of the calculation of value added tax on non-taxable transactions. Taxes and taxation, 1, 49-54.

26. Timoshina, T. A. (2019). Problems and directions of improving the mechanism for reimbursement of value added tax. Taxes and taxation,5, 35-44.

27. What is the safe share of VAT deductions in 2022 by region [Electronic resource]. URL: https://www.buhsoft.ru/article/4043-bezopasnaya-dolya-vychetov-po-nds-v-2022-godu-po-regionam (Date of access: 05/01/2022).

28. Safe share of VAT deductions in 2021 [Electronic resource]. URL: https://www.b-kontur.ru/enquiry/807-bezopasnaya-dolia-vichetov-po-nds?utm_source=google&utm_medium=organic (date of access: 05/02/2022).

First Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

Accounting tax policy on value added tax of agricultural production organizations Tax regulation of agriculture in the context of the need to ensure food security in Russia is becoming a key issue that requires the attention of scientists and practitioners. The issues of taxation and value-added tax accounting come to the fore here due to the significance of VAT in the structure of the tax burden of agricultural enterprises, as well as the features and breadth of possibilities for applying a reduced rate by enterprises producing and processing agricultural products. The article is devoted to the study of the problems of formation of accounting policy for the purposes of VAT taxation by agricultural enterprises. In the article, the author, in accordance with the requirements of the journal, has allocated 4 sections: "Introduction", "Main part (justification)", "Results", "Conclusions". The Introduction defines the relevance and significance of the chosen research area. In the "Main part" the author considers the issues necessary for inclusion in the accounting policy for the purposes of taxation of agricultural enterprises. The section "Results" describes the provisions that can be recommended for inclusion in the Accounting Policy for the purposes of taxation and optimization of VAT by agribusiness organizations. At the end of the article, the conclusions of the study are presented. We suggest that the author pay attention to the rationale for choosing agricultural enterprises for research, as well as focusing on the features of the selected sector of the economy in the text of the article and in the recommendations. The author does not consider the problem posed more broadly regarding the contribution of the agro-industrial complex to the volume indicators in the whole country. What is the share of the agricultural sector in value added, taxes and fees paid? What is included in the concept of agriculture is also not clear due to the fact that today there are different approaches. It is also necessary to adjust the figures in the Introduction: it is stated that the growth rates are presented in times, and the figure in the legend indicates an indicator in billion rubles. Inaccuracies must be eliminated to ensure an unambiguous interpretation of digital information. The author does not stop at the issues of studying the problem of integration into accounting software products of a number of proposed provisions and forms of the register in order to ensure automation of accounting processes. How expensive is it? Does this require the development of separate accounting registers that are not integrated into accounting programs? The methodological basis of the research is analysis, synthesis, ascent from the abstract to the concrete, logical and historical method, as well as other general scientific methods. Among the specific economic methods, the author uses the analysis of statistical data, the analysis of time series. The article uses illustrative material, which helps to increase the level of perception of the research results by the readers of the journal. The author presents 2 figures and 1 table. The relevance of the article is beyond doubt. Under the conditions of sanctions pressure, domestic agricultural enterprises should become more effective in ensuring Russia's food security. To do this, it is necessary to use the entire arsenal of tools to stimulate the development of agriculture, including tax regulation. Organizations themselves can also implement areas of tax planning and optimization, which requires consolidation in accounting policies for tax purposes. At the same time, VAT becomes one of the key ones for the attention of taxes, since it accounts for the largest share in the structure of the tax burden of agricultural enterprises. The article has practical significance, since the presented research results can be used in the activities of agricultural organizations in order to optimize the VAT tax burden. Of particular interest in this regard are proposals for the inclusion in the accounting policy for tax purposes of provisions on VAT tax accounting and the form of the register of separate VAT accounting. However, it would be advisable to illustrate the value of the results obtained using a practical example of an agricultural enterprise. The article does not explicitly present the elements of scientific novelty, it is not obvious. The author needs to formulate a vision of the increment of scientific knowledge within the framework of the conducted research. The presentation style is scientific and meets the requirements of the journal. At the same time, some shortcomings and errors are not excluded. The bibliography is presented by 28 sources: mainly research by Russian scientists. The positive thing is that the bibliography includes mainly relevant sources from 2018-2022, reflecting the results of current research in this field. The advantages of the article include, firstly, the relevance and significance of the chosen research area. Secondly, a systematic approach to analyzing the possibilities of reducing the VAT tax burden for agricultural enterprises. Thirdly, the breadth of the use of relevant domestic sources in the field under study. Fourth, the undeniable practical value of the research results. The disadvantages include the following. Firstly, the lack of formulated elements of scientific novelty. Secondly, there is a lack of emphasis on the sectoral features of accounting policy for tax purposes specifically for agricultural enterprises. Thirdly, there is a lack of justification for the relevance of the study in the context of the crisis events of 2022, and the lack of breadth of view on the problem under study. A number of methodological issues raised at the beginning of this review require clarification. Fourth, there is a lack of a practical example of testing proposals at an agricultural enterprise, which is typical for articles of this kind. Conclusion. The article is devoted to the study of the problems of formation of accounting policy for the purposes of VAT taxation by agricultural enterprises. The article is able to arouse the interest of a wide readership of the magazine. It is recommended to accept for publication in the journal "Taxes and Taxation", provided that the comments indicated in the text of this review are eliminated.

Second Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the study. Taking into account the stated topic, the article should be devoted to the accounting tax policy on value added tax of processing organizations of the agro-industrial complex. In general, the content of the article corresponds to the stated topic. Research methodology. The article presents an analysis of an array of data: VAT payments by type of economic activity, the structure of the tax burden by type of economic activity, the rate of dynamics of tax payments by type of economic activity. It is valuable that data processing is accompanied by the construction of graphical objects (tables and diagrams). At the same time, it is recommended to enhance the quality of their analysis by forming problems, which are evidenced by the content of these graphic objects. The relevance of the study is beyond doubt, because the economic performance of a particular organization depends on the quality of the accounting tax policy. At the same time, it must be built in strict accordance with the current legislation. In this regard, the study of the issue is also of interest from the point of view of its improvement in order to create opportunities for maneuvering accounting policies depending on certain internal and external factors. The scientific novelty in the reviewed article is partly present. In particular, the formulated features of the development of accounting policy for tax purposes are of interest (including certain features are presented in the context of the activities of organizations of the agro-industrial complex). Style, structure, content. The style of presentation of the text in the reviewed article is scientific. The structure of the article is built, in general, competently. However, it is recommended to supplement it with a structural element, within which the author's recommendations for solving the identified problems will be presented (which are also not clearly indicated in the text of the article). The content of the article, first of all, is recommended to be finalized in the key of strengthening the link to the organizations of the agro-industrial complex, which is stated in the topic of the article. For example, the author is recommended to accompany all the features of the development of accounting policies for tax purposes with examples relevant to organizations of the agro-industrial complex, which will ensure that the content of the article is more consistent with the stated topic. The author rightly notes in the article that "such circumstances indicate the need for closer attention to the accounting tax policy and the directions of its continuous improvement." However, in the text of the article, it was not possible to find specific author's proposals to ensure this improvement. Bibliography. The author considers a large list of sources, first of all, publications of domestic researchers of the issues considered in the article. It is also recommended to look at foreign literature to expand the number of possible approaches to solving existing problems. At the same time, the list of sources is duplicated twice in the text of the article – it is recommended to eliminate this technical inaccuracy. Appeal to opponents. Despite the impressive bibliographic list, there was no discussion of the results obtained and no scientific discussion with the results of research conducted by other authors in the text of the article. It is recommended to eliminate this remark, including specifying what is the increment of scientific knowledge? Conclusions, the interest of the readership. Taking into account all the above, the article can be recommended for publication, since the chosen topic is of interest to scientists involved in the development and implementation of accounting tax policy, as well as to officials responsible for these processes in organizations (including the agro-industrial complex).

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.