|

DOI: 10.25136/2409-8647.2022.2.34346

EDN: RHXVGU

Received:

17-11-2020

Published:

06-07-2022

Abstract:

The article examines the situation related to the development and problems in Russian small and medium-sized enterprises over the past decade. The assessment of the institutional environment of entrepreneurship at the present stage of its existence is given. The subject of the study is the processes taking place in this sector of the economy. The purpose of the article is to study the peculiarities of the development and existence of Russian small and medium-sized businesses.The theoretical and methodological basis was made up of articles by authors directly involved in business, as well as authors considering this economic activity from a methodological point of view. Changes in the institutional environment of the economy are becoming particularly relevant due to the challenges associated with sanctions restrictions against the country, as well as the serious dependence of the budget on oil and gas trade in raw materials, where energy prices have recently collapsed.The materials of the article can be used by mass media focused on the problems of domestic entrepreneurship. The novelty of the article primarily consists in a comprehensive analysis of the situation in this sector of the economy over the past decade. The state of the country's economy directly depends not only on the players of big business, but also largely on the objects of small and medium-sized enterprises, since they use local labor, raw materials and production resources on the territory. Therefore, economic diversification is currently an important issue for the state economic policy of the state, and it is small and medium-sized businesses that could become the locomotive that would allow the country to get out of further technological and socio-economic distress.

Keywords:

small business, medium-sized businesses, economic diversification, socio-economic stability, domestic business, geographical location, regional support, solvency, company, foreign economic activity

This article is automatically translated.

Introduction. The relevance of the article lies in the fact that the development of small and medium-sized businesses is a necessary condition for the full-fledged existence of economic and social stability of any country in the modern world. The proposed article provides a brief description of the state of small and medium-sized businesses (SMEs) in recent years and statistical data that largely characterize the current situation of this sector of the economy. By definition, Khamidullina F.F. – small business is an independent sector of the economy. Possessing significant innovative potential, producing goods, works and services, based on the use of individual labor, private and personal property, a limited amount of resources (labor, capacity, etc.) [1]. The purpose of the study was the author's desire to briefly highlight the situation in small and medium-sized businesses both in the recent past and today, the most important sector of the economy in the whole world and, accordingly, in Russia. Methods and materials. To write the article, it took the collection of statistical data and the reading and comprehension of many articles whose authors are people directly involved in business. The fundamental points of the theory of entrepreneurship were outlined in the works of foreign economists A.Marshall, P.Samuelson, J.K.Ken, D. North and others, as well as in the studies of domestic scientists such as E.Buchwald, O.Yemelyanov, V. Fadeev, V. Radaev and many others. Here it is necessary to pay attention to the fact that the problems of entrepreneurship highlighted in Western publications are quite seriously different from Russian ones. Accordingly, for Russia, the research conducted on this topic is undoubtedly a new scientific direction. According to the author, N. Zubarevich's articles are also interesting, although her research field is not focused specifically on the problems of small and medium-sized businesses, however, it makes it possible to look more broadly at the economic situation in the country as a whole. Results. In Russia, the emergence of small and medium-sized businesses at the present stage falls on the period since 1985. For the revival of business in the country, the adoption of the law "On individual activity" - the USSR Law of 19.11.1986, the National Program for the support of small and medium-sized businesses, the basic law "On state support of small and medium-sized enterprises" has been in force in the country since 1995. Of course, concrete measures taken to develop this economic activity in the country, led to positive results. However, it is worth noting that the existing growth in the number of enterprises is still mainly in the intermediary sphere and industries that do not require significant material investments, such as trade, catering, construction of civil facilities, and provision of household services to the population. In addition, the development of this sector of the economy is still fraught with great difficulties. There are still enough obstacles for the full-fledged development of small and medium-sized enterprises (SMEs). The share of small and medium-sized businesses in Russia's GDP at the end of 2019 was not much more than 21%, while in highly developed countries this figure is significantly higher from 50% to 90%, in the same Mongolia, although it is difficult to classify this country as highly developed, however, the share of SMEs in the country's GDP is more than 60%. Russian entrepreneurs will remember the last decade by the fact that in 2010, in addition to the unified social tax (UST), employers had to pay insurance premiums to extra-budgetary funds. The contribution rate for enterprises working on simplified taxation and UTII was at the level of 14%, and for those working on the general taxation system – 26%, namely: Pension Fund – 20%, mandatory medical insurance funds – 1.1%, territorial funds of compulsory medical insurance – 2% FSS – 2.9%. A year later, the insurance premium rate was raised to 34%. The increase in contributions was explained by the need to fill the deficit of the Pension Fund. Such a reform, according to experts, primarily affected the least well-off businesses. The response to the innovations was an increase in prices for consumers for goods and services, and the departure of many enterprises into the shadows. In 2012, the authorities partially listened to the opinion of entrepreneurs by reducing the rate, but not to 26% as requested by the business, but to 30% [2]. In 2015, the Platon system began to operate. According to this system, a fee has begun to be charged from trucks with a maximum mass of over 12 tons. According to the Ministry of Economic Development, the cost of cargo transportation in 2016 increased by almost a quarter, which led to an increase in consumer inflation and a decrease in the cargo fleet. Since January 2016, a three-year moratorium on scheduled inspections has been in effect in the country, but the number of unscheduled inspections has increased and by 2019, according to the Institute of Law Enforcement Problems of the European University, it has led to an increase of planned and unscheduled inspections by a third. The leaders in such supervision were Rospotrebnadzor and the Ministry of Emergency Situations of Russia. Since the beginning of 2019, more than 700 companies have closed in Russia and most of them were officially registered and did not go into shadow business. A lot of problems lead to the closure of enterprises. On the part of the business community, there are complaints about the work of supervisory authorities, i.e. business should receive really modern standards that will be understandable to entrepreneurs and supervisory authorities, the uncertainty of the economic situation, especially recently, a high level of taxation, not high availability of loans, a declining level of demand in the domestic market as a result of a decrease in the standard of living of the population due to small pensions and wages, VAT and environmental charges for garbage collection, labeling of food and essential goods have increased in the last year. Individual entrepreneurs are forced to purchase expensive equipment for scanning labeled products and for reporting to the Federal Tax Service (FTS). Of course, large retail chains can cope with the new rules without much material costs, but small businesses and individual entrepreneurs are unlikely. Under the burden of new exorbitant expenses for their activities, it is possible that they will be forced to leave the market or significantly reduce staff, and possibly go into shadow business. The initiative of the Russian government also caused a predictable reaction among the participants of the EAEU Customs Union. "The head of one of the associations of entrepreneurs of Kazakhstan stated that the cost of control and identification signs only for 7 main items (tobacco, alcohol, beer, medicines, milk, juices and water, perfumes and cosmetics) will be comparable to the land tax collected per year from all individuals and legal entities of Kazakhstan. The scale of the tragedy is frightening for the economy" [3].

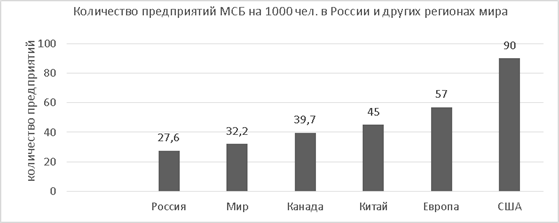

Experts of the Institute of Growth Economics named after Stolypin noted that most of the tax revenues from business, although accounted for by large enterprises, but the burden (relative to profit) on small and medium-sized enterprises is still higher. "The high tax burden does not allow small and medium-sized enterprises to develop, stimulates them not to grow, but to split and squeezes them into the shadow sector" [4]. Federal Law No. 115-FZ dated 07.08.2001 "On Countering the legalization (laundering) of proceeds from crime and the financing of terrorism" also creates serious problems for entrepreneurs. The fact is that banks have the right to block the accounts of citizens who make payments through online transfers. But such calculations are modern realities all over the world. Unblocking an account is quite a troublesome task. It is not always possible to prove at the bank that your business is officially registered, all taxes are paid and you have nothing to do with criminal actions. Sometimes there is a need to file an application to the court, and these are long waiting periods, which ultimately quite often lead to the collapse of entrepreneurial activity. Today, the number of small and medium-sized businesses in Russia is significantly lower than the global average (Fig. 1). Figure 1. Number of SMEs per 1000 people in Russia and other regions of the world[1]

The penetration density of SMEs at the beginning of 2020 reached above the global average only in a small number of regions of the country, including St. Petersburg (39.1 per 1000 people), Moscow and the Moscow Region (37.4), as well as in Kaliningrad, Novosibirsk, Sverdlovsk, Tyumen regions, and in regions with low population density in in general, such as the Sakhalin and Magadan regions[5].The level of development of SMEs and the degree of involvement of the population in this sector in different regions are different, respectively, and depends on many factors, including unemployment rates, infrastructure development, education of the population, the amount of consumer demand that directly depends on the solvency of the population for goods and services, the availability of borrowed funds, energy tariffs, rental prices, etc. land plots, natural and climatic factors, peculiarities of legal regulation in the region in the field of business and much more.

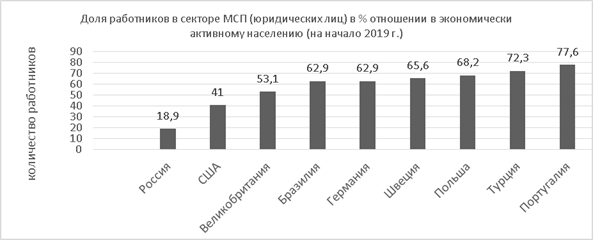

Figure 2. The share of workers in the SME sector in % by region of the world Source: Stolypin Institute of Growth Economics based on data from the OECD, the UN and the Federal Tax Service of Russia. The involvement of the population in this sector of the Russian economy also lags far behind economically developed countries. (Fig. 2). At the end of 2019, this figure was about 19%. In connection with these circumstances, Decree of the President of Russia No. 204 of May 7, 2018 "On national goals and strategic objectives for the development of Russia for the period up to 2024" set the task of increasing the number of people employed in SMEs from 19 to 25 million people by 2024. However, according to the Federal Tax Service, the number of employees employed in small businesses for 9 months of 2019 decreased by more than 400 thousand people, while the goal is to increase their number and very significantly [6]. Official data on the number of participants in entrepreneurial activity from the tax service and Rosstat are very different. It is really difficult to accurately count the number of enterprises, because small businesses are very mobile, many register and do not operate, many simply close, many are in the shadows. According to the data of the Tax Service and the Ministry of Economic Development, the main regions where from August 2018 to August 2019 the main part of the enterprises that ceased their activities fell on Moscow, St. Petersburg, Tatarstan and the Moscow region. Although these regions, according to experts, are among the top ten in terms of the development of small and medium-sized businesses. The head of the Corporation of Small and Medium-sized Enterprises believes that one of the reasons for what is happening may well be high competition in these regions.

2020 was not an easy test for small and medium-sized businesses. The coronavirus pandemic and the restrictive measures associated with it have caused irreparable damage to many businesses, and first of all, it is the tourism business. Retail trade, primarily non-food products, also suffered serious losses. A significant drop has also occurred in the catering sector, where losses are estimated at about 50%. The Government has taken measures to support SMEs, namely, announced a delay in the payment of insurance premiums, but this is only a one-year delay. It is also supposed to provide direct financial support in the form of subsidies (grants), which can be spent on wages and payment of debts for utilities. The amount of these subsidies is 12,130 rubles. and it is determined from the minimum wage (minimum wage). The condition for receiving this money should be the complete preservation of the composition of employees in April and May 2020. However, it is worth noting that not all businessmen received such support. This conclusion was made possible by the conversation of the author of the article with two entrepreneurs (a dental clinic and a sewing workshop). Not a single employee was dismissed during this period, the relevant documents were issued and transferred to the destination, nevertheless, payments were not made. Obviously, it is unlikely that it will ever be possible to obtain complete statistics on the discrepancy between the declared support measures and the SMEs that have received this support in the country. In addition, not all SMEs were included in the list of affected industries, and those who were lucky enough were provided with an anti–crisis measure - a reduction in the rate of social contributions from 30 to 15% and the possibility of termination of lease agreements. The largest reduction in 7 months of 2020 occurred among microenterprises – by 459700. The number of medium-sized companies with up to 250 employees and annual revenue of up to 2 billion rubles, on the contrary, increased by 497 (by 5.2%) compared to previous years and amounted to 17,562 units. Despite all the negative aspects, in 2020 there was an increase in the number of people employed in business, which indicates a correct and timely decision to reduce insurance premiums, to pay direct subsidies for the minimum wage of employees, tax holidays and partial restructuring of loans. The measures taken to support entrepreneurs to some extent made it possible to "whitewash" business and many companies have already formalized their employees in order to be able to receive subsidies from the state and, accordingly, also benefits [7]. Based on the criterion of economic efficiency, as well as the employment of labor resources, it is worth paying attention to the fact that the diversification of the country's economy is currently becoming the most important task "and a generally favorable economic phenomenon. It is very beneficial because it encourages the creation of flexible economic structures that absorb innovative and highly profitable areas of activity, and also prevents the reduction of declining industries" [8]. Particular attention should be paid to the development of innovative forms of business, since many regions of the country have a significant concentration of scientific and research institutions capable of diversifying industrial production and expanding the innovative base of its development. Such a process could facilitate the entry of domestic producers into international markets. Trade in raw materials is no longer relevant in many positions. "In the context of economic globalization, competition is becoming tougher, which determines the objective need for the transition of the Russian economy to innovative development tracks aimed at increasing its competitiveness and ensuring high economic growth" [9]. In recent years, according to the Federal Customs Service, Russia's oil and gas exports have not increased and surpassed oil and gas sales, namely, trade in food products, gold and, remarkably, high-tech goods. At the beginning of 2019, the government approved the passport of the national project "Small and medium-sized entrepreneurship and support for individual entrepreneurial initiative", where the goal is to actively support small businesses with access to international markets. Many researchers and economists believe that it is export-oriented SMEs that are the stimulating factor that makes the greatest contribution not only to the development of the national economy of the country, but the entire world economy as a whole. First of all, the state should help domestic entrepreneurs enter the international arena. Which is exactly what the national project is aimed at. The direction of state support for non-primary exports is concentrated in the hands of the Russian Export Center (REC), which has representative offices in almost all republics, territories and regions of the country. So far, the contribution of most entities to domestic exports is very small and does not correspond to the potential, according to experts, which Russian entrepreneurs undoubtedly have. The difficulties faced by domestic entrepreneurs are primarily related to self–doubt, as well as among a large number of SME support programs there is no very significant one - subsidizing the interest rate for small and medium-sized businesses engaged in foreign economic activity, as well as problems with product certification and participation in international specialized exhibitions, due to large material costs. The existing statistics of entrepreneurial business allows us to make a rating of countries in which the most favorable conditions for entrepreneurs have been created. Russia is in 40th place in this ranking. The first place belongs to New Zealand. Good conditions for this activity have been created in Denmark, Singapore, South Korea, the UK, the USA, Germany and other countries. Russian exporters of small and medium-sized businesses provide less than 9% of all domestic exports. According to the structure of all exports, the raw materials sector accounts for almost half, i.e. 47.7%, non-primary non-energy exports account for 33.24%, which includes a modest figure of 8-9%, i.e. the share of SMEs.[2] The country's leadership is setting quite ambitious goals for the future, namely, increasing the share of the country's GDP to 40% by 2030. However, many experts consider this figure to be divorced from reality, since for a number of very serious reasons already partially outlined in the article above, obviously such a thing is unlikely to be feasible. As practice has shown, small and medium-sized businesses are really a mandatory and important condition for the socio-economic development of the country. However, the mechanisms of state regulation of Russian entrepreneurship in the form of measures of both state and municipal support were insufficient [10].

Conclusions. A rather paradoxical situation is developing in this sector of the economy, where domestic business continues to develop not due to the prosperous state of the business climate in the country, but despite all the difficulties and obstacles that have existed for a long period of time. The reluctance of Russian companies to export so far is dictated by both financial difficulties and self-doubt, lack of skills to work with foreign partners and markets in general, and many other reasons. The Russian Export Center is called upon to overcome difficulties with access to world markets. The state of the country's economy directly depends not only on the players of big business, but also largely on the objects of small and medium-sized enterprises, since they use local labor, raw materials and production resources on the territory. There is no doubt that for the further development of small and medium-sized businesses, competent management of this process is necessary. And the stated measures to support entrepreneurs must be strictly implemented, in addition, the stabilization of the economic situation in the country also plays an important role in the development of small and medium-sized businesses. [1] Business statistics. URL: https://vavilon.ru/statistika-biznesa/user=5 [2]Business statistics. URL: https://vavilon.ru/statistika-biznesa/user=5]

References

1. Khamidullin F.F. Problemy malogo i srednego biznesa. Predprinimatel'stvo//Evraziiskii mezhdunarodnyi nauchno-analiticheskii zhurnal//Problemy sovremennoi ekonomiki. ¹ 3 (19/20). 2006

2. Afanas'ev S. 2010-2020: Itogi razvitiya dlya malogo i srednego predprinimatel'stva. URL: http://news.ati/su/article/2020/01/09/2010---2020-itogi-desyatiletiya-dlya-malogo-i-srednego-predprinimatelstva-160927/

3. Artemov S. Kuda zavedet malyi biznes sistema markirovki tovarov. URL: https://www.mk.ru/economics/2019/12/16-kuda-zavedet-malji-biznes-sistema-markirovki-tovarov.html

4. Kedik S. Oblegchit' nadzor gil'otinoi. Ekspert-Sibir'.-¹05-06.-28 01-10 02.2019].

5. Pan'kov V. Klaster, eksport, MSP//Moi biznes, vypusk ¹ 2, 2019. URL: https:plus.rbc/nevs/5db5d3cf7a8aa9cf77cbddb6

6. Bleiman N. Zametnoe otstavanie. URL: https://plus.rbc.ru/specials/malyi-i-srednij-biznes-gospodderzhka-predprinimatetelstva-v-rossii

7. Morozova T. V Rossii sokratilos' chislo malykh predpriyatii.URL: https://www.vedomosti.ru/business/articles/2020/08/11/836350]

8. Ryshard Doman'skii. Ekonomicheskaya geografiya: dinamicheskii aspekt. M.: Novyi khron, 2010.-s.275]

9. Smirnova G.P., Strel'nikov A.G. Diversifikatsiya i maloe predprinimatel'stvo kak faktor ekonomicheskogo razvitiya. URL: https://cyberleninka.ru/article/n/diversifikatsiya-i-maloe-predprinimatelstvo-kak-faktor-ekonomicheskogo-razvitiya/viewer

10. Loguntsova I.V. Mekhanizmy gosudarstvennoi podderzhki malogo predprinimatel'stva v Rossiiskoi Federatsii//Vestnik MU.-ser.21, Upravlenie.-2009.-¹4. – s.69-77.

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.